Second stimulus check updates: Congress agrees on $900 billion COVID-19 relief plan

|

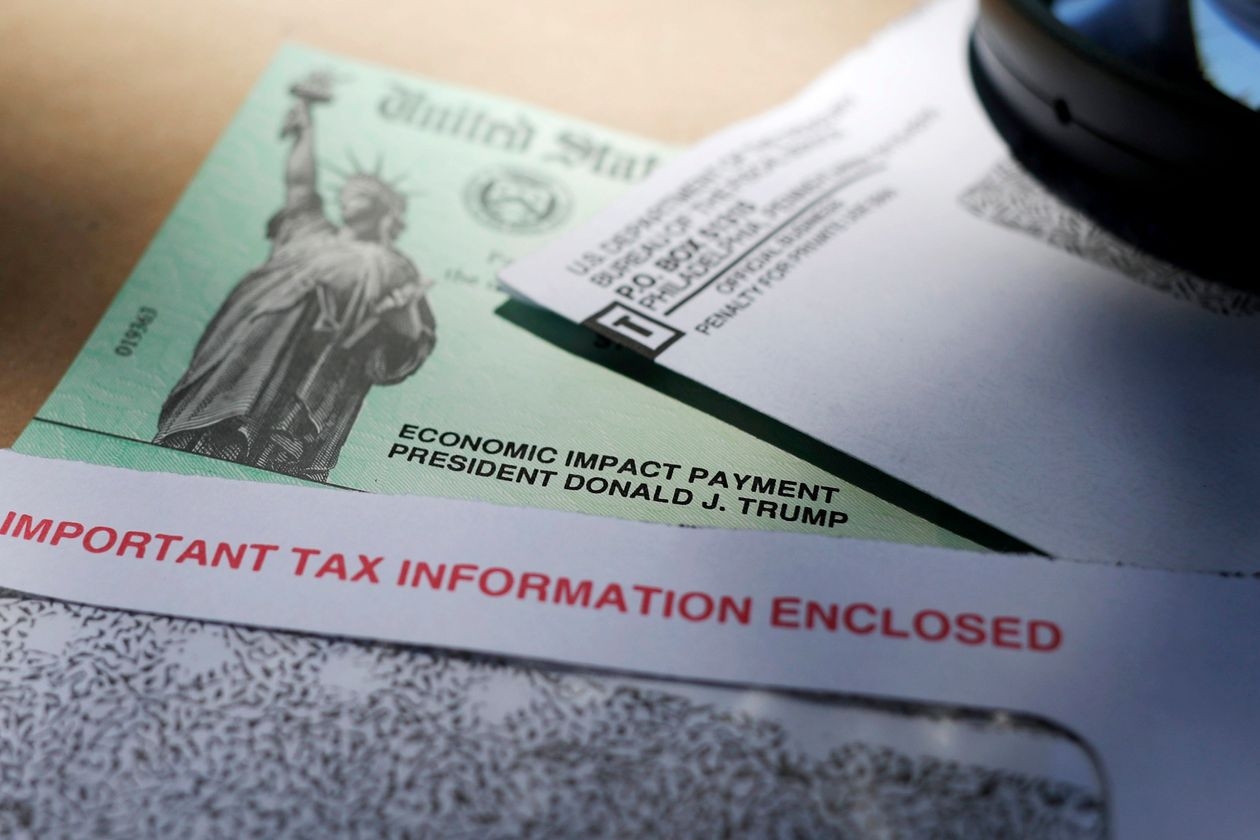

The first batch of payments could go out at the beginning of next week, Treasury Secretary Steven Mnuchin said Monday (Photo: AP) |

Lawmakers tacked on a $1.4 trillion catchall spending bill and thousands of pages of other end-of-session business in a massive bundle of bipartisan legislation as Capitol Hill prepared to close the books on the year, according to Chicago Tribune.

The relief package, agreed to on Sunday and finally released in bill form Monday afternoon, remained on track for votes in the House and Senate. It would establish a temporary $300 per week supplemental jobless benefit and a $600 direct stimulus payment to most Americans, along with a new round of subsidies for hard-hit businesses and restaurants and money for schools, health care providers and renters facing eviction.

The 5,593-page legislation — the longest bill ever by far — came together Sunday after months of battling, posturing and postelection negotiating that reined in a number of Democratic demands as the end of the congressional session approached. President-elect Joe Biden was eager for a deal to deliver long-awaited help to suffering people and a boost to the economy, even though it was less than half the size that Democrats wanted in the fall.

The House was cruising to a vote Monday night and the Senate was expected to vote shortly afterward. Congress was passing a one-week stopgap spending bill to avert a partial government shutdown at midnight and give President Donald Trump time to sign the sweeping legislation.

Treasury Secretary Steven Mnuchin, a key negotiator, said on CNBC Monday morning that the direct payments would begin arriving in bank accounts next week.

Democrats’ viewpoint on the stimulus check

Democrats acknowledged it wasn’t as robust a relief package as they initially sought — or, they say, the country needs.

“This deal is not everything I want — not by a long shot,” said Rules Committee Chairman Jim McGovern, R-Mass., a longstanding voice in the party’s old-school liberal wing. “The choice before us is simple. It’s about whether we help families or not. It’s about whether we help small businesses and restaurants or not. It’s about whether we boost (food stamp) benefits and strengthen anti-hunger programs or not. And whether we help those dealing with a job loss or not. To me, this is not a tough call.”

Democrats promised more aid to come once Biden takes office, but Republicans were signaling a wait-and-see approach.

|

| Rules Committee Chairman Jim McGovern, R-Mass (Photo: WBUR) |

The final agreement would add to a national debt that has spiked by $7 trillion to $27.5 trillion during Trump’s term.

The measure would fund the government through September, wrapping a year’s worth of action on annual spending bills into a single package that never saw Senate committee or floor debate.

On direct payments, the bill provides $600 to individuals making up to $75,000 per year and $1,200 to couples making up to $150,000, with payments phased out for higher incomes. An additional $600 payment will be made per dependent child, similar to the last round of relief payments in the spring.

The $300 per week bonus jobless benefit was half the supplemental federal unemployment benefit provided under the $1.8 billion CARES Act in March. That more generous benefit and would be limited to 11 weeks instead of 16 weeks. The direct $600 stimulus payment was also half the March payment.

When you’ll get it

As reported by CNBC, first in line will likely be individuals who already have their direct payment information on file with the IRS.

Within two weeks of the CARES Act going into effect in March, more than 81 million payments were disbursed, totaling more than $147 billion, all through electronic transfers to recipients’ bank accounts, according to the Government Accountability Office.

“I was surprised last spring at how rapidly the Treasury Department was able to roll out the economic impact payments,” said Janet Holtzblatt, senior fellow at the Urban-Brookings Tax Policy Center.

Treasury Secretary Steven Mnuchin has already promised a similarly aggressive timeline, saying that he could start processing checks as soon as the legislation passes.

“I can get out 50 million payments really quickly. A lot of it into people’s direct accounts,” Mnuchin previously said in August.

That includes those who signed up to receive a refund by direct deposit when filing their 2018 and/or 2019 taxes, and it may also extend to the 14 million people who previously registered their details via two new online tools the IRS built this spring to collect banking and contact information.

If the qualifications for compensation remain the same as those outlined in the CARES Act, many individuals who receive Social Security or Supplemental Security Income (SSI) benefits will also be eligible for full rebates.

But how fast that money is received is largely dependent on whether the recipient already uses direct deposit for their monthly benefit payment. If they do, the stimulus cash will likely be credited to their account automatically.

If Social Security benefits are sent by mail, however, a longer wait is expected.

For those who are eligible for a stimulus payment but have not shared their bank account details with the IRS, they can expect to instead receive a paper check or a prepaid debit card.

|

| (Photo: Marketplace) |

Commonly-asked questions

What are the income limits?

The payments start phasing out when individual adjusted gross income exceeds $75,000, when head-of-household income exceeds $112,500, and when income for married couples filing jointly exceeds $150,000. For individuals without children, the payments go to zero when income reaches $87,000; that is $174,000 for married couples. The numbers are generally based on 2019 income.

What if my income or family size has changed?

As with the first round, households that qualify for a larger benefit based on their 2020 income can claim the difference between what they received and what they should have received. They can do that on the 2020 tax return. The Internal Revenue Service typically starts allowing tax filing in late January and makes refund payments within a few weeks of receiving returns, WSJ said.

What if I get too much money? Is the payment taxable?

The payments aren’t taxable income. Think of them as an increase to the tax refund you would normally receive in early 2021 and an early payment of that. If you get too much money—which can happen if you qualified based on 2019 income and your 2020 income was too high to get paid—you don’t have to pay back the difference.

Are college students and adult dependents eligible?

No, only children younger than 17 are expected to be eligible.

What about people without Social Security numbers?

This is an important change from the first set of payments. People without Social Security numbers—often unauthorized immigrants—are still not eligible, but their presence in a married couple doesn’t make their entire household ineligible.

Such mixed-status households can get payments this time based on the number of eligible people in the household—in contrast to the spring round, when they couldn’t get any money. And this change is retroactive, so they can claim an amount for the first payment as part of their 2020 tax returns.

What about deceased people?

This bill is much clearer than the spring version about the eligibility of people who have died. Anyone who died before Jan. 1, 2020 is ineligible but those who died this year are eligible.

Will the government or my bank withhold part of my check to pay debts I may owe?

Unlike typical tax refunds, these payments won’t be subject to garnishment in most cases, including student debt and state debt. And lawmakers added language limiting garnishment by banks this time around. They did retain rules that allow payments to be seized for overdue child support.

| Vietnam is an attractive investment destination for Japanese enterprises post Covid-19 Japanese enterprises regard Vietnam as an attractive investment destination following the latter’s success in controlling the COVID-19 pandemic, Ambassador Yamada Takio told a conference in ... |

| Second round of coronavirus stimulus checks, what we should know Following a direct check of US$1,200 to millions of Americans impacted by the coronavirus pandemic, the Trump administration has recently unveiled a US$3 trillion relief ... |

| U.S. Citizens whose spouse is an immigrant are blocked from getting Stimulus Checks Trump blocks stimulus funding for millions of US citizens married to immigrants,who file taxes jointly with a spouse lacking a Social Security number denied COVID-19 ... |

Recommended

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World