Who eligible/ineligible for the second stimulus check

|

| Stimulus payments will not be taxed — and you may be eligible to collect additional stimulus money (Photo: USA Today) |

The stimulus measure, which was attached to the $1.4 trillion government spending bill, includes a fresh round of stimulus checks, an extension of unemployment benefits and more funding for the Paycheck Protection Program.

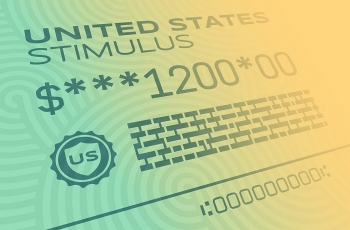

The $600 stimulus checks are not only half the size of the $1,200 payments sent out earlier this year with the passage of the March CARES Act, but the eligibility formula to receive the money is less generous than the first round.

Who are eligible?

According to Fox Business, American adults who earned less than $75,000 in 2019 will receive the full $600 check, while couples who earned less than $150,000 will receive $1,200.

The payments will be tapered for higher-earners (5% of the amount by which their adjusted gross incomes exceeded the initial threshold) and phased out completely for individuals who earn more than $87,000 and couples who earn more than $174,000.

The income threshold under the CARES Act legislation was higher: Individuals who earned less than $99,000 were eligible to receive the money, while couples who earned less than $198,000 would receive a check.

Still, dependents under the age of 17 are eligible for up to $600 payments – more than the $500 limit in the CARES Act – meaning that a family of four could receive up to $2,400.

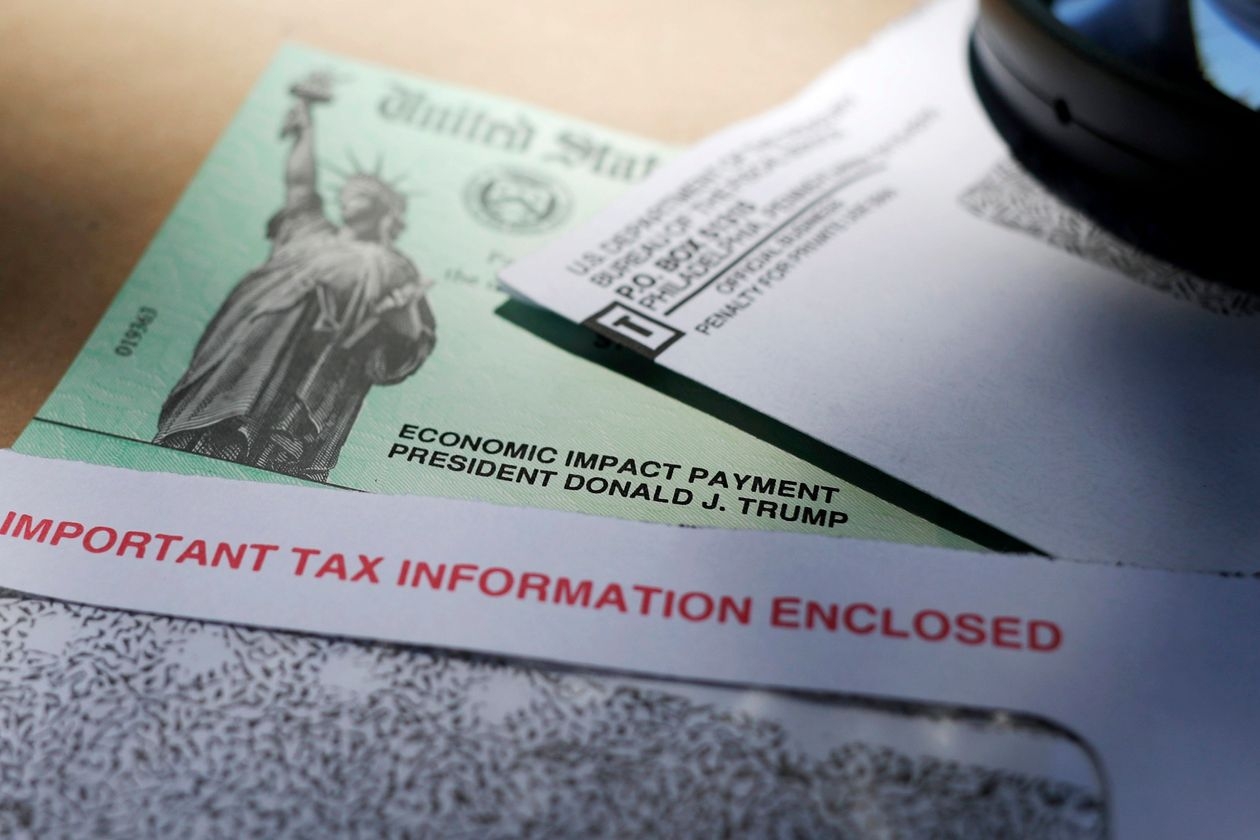

|

| (Photo: Captured) |

The deal also includes a provision, retroactive to the CARES Act, to expand the checks to mixed-status households, allowing American citizens who are married to foreign nationals without Social Security numbers to receive the aid.

Individuals who have no income and federal benefits recipients are eligible for the full check amount, just like the first round of payments.

You can use this free calculator from Omni to see how much money you can expect to receive from the stimulus deal.

Americans can expect to see the money start going out as soon as next week, according to Treasury Secretary Steven Mnuchin.

“People are going to see this money [at] the beginning of next week,” he said during an interview with CNBC Monday morning. “Much needed relief – and just in time for the holidays.”

It took the government about two weeks after the passage of the CARES Act to begin sending out checks via direct deposit; almost two weeks after the $2.2 trillion package passed, the Treasury Department disbursed more than 81 million payments worth more than $147 billion, all through electronic transfers to recipients’ bank accounts, according to the Government Accountability Office.

Who is ineligible?

Many students, for instance, don't qualify. Neither do immigrants who don’t have a Social Security number. Some elderly and disabled people won’t get a check either, along with high-wage earners, USA Today reported.

The payments, which aim to give Americans a quick cash infusion, will be distributed if Trump signs the bill into federal law. That routine signing was upended late Tuesday when the president criticized the bill and urged Congress to increase the stimulus checks to $2,000 from $600, although he stopped short of threatening to veto it as of Wednesday afternoon.

High-wage earners

If your income is too high, you won’t get a check. The payments are phased out for Americans at income thresholds based on their 2019 tax returns.

For instance, individuals earning up to $75,000, and couples making less than $150,000 will receive the full, one-time amount of $600, which is half the value of the first round of $1,200 checks issued under the CARES Act in March. The amount drops by $5 for every $100 of income above those income thresholds. It will phase out completely at $87,000 for individuals and $174,000 for couples.

If you claimed the head of household filing status on your tax return, you won't get a payment if your adjusted gross income exceeds $124,500.

Unemployed high-wage earners

Eligibility for stimulus checks will be determined by 2019 tax returns, a change from the first round of payments that were based on 2018 or 2019 tax returns. That could change how much you receive and whether you get a second check. If you earned more than $87,000 last year but are unemployed in 2020, you won’t be eligible for a payment.

Some people who earned significantly less income this year than they did on their 2019 tax return could be eligible for a refundable tax credit for their second stimulus payment when they file their 2020 tax return, according to Toby Mathis, a partner and attorney at Anderson Law Group in Las Vegas, Nevada.

Students

Students age 17 or older don’t qualify for a stimulus check if their parents or guardians claim them as dependents. That means the stimulus excludes millions of high school and college-aged Americans.

Their parents also won’t get a payment of $600 per child that the new stimulus package offers. It applies only to children 16 and younger. There is no cap on the number of child dependents that a household can claims, so a family of four would receive up to $2,400.

Some elderly and disabled adults

Adult dependents don’t qualify for a check, which means an elderly parent or family member living under the care of an adult child that is claimed as a dependent won't get a direct payment.

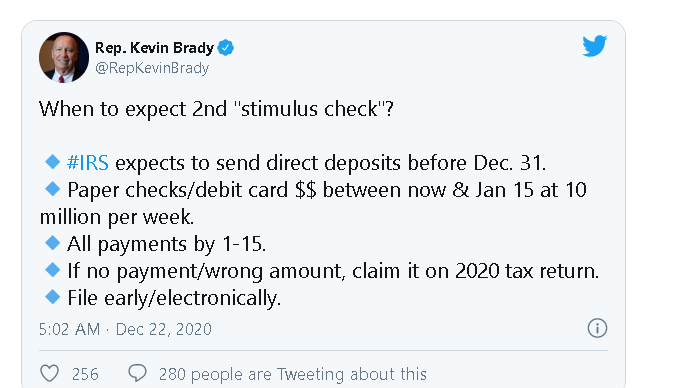

|

| (Photo: CBS News) |

Some immigrants

Those without Social Security numbers, typically unauthorized immigrants, aren’t eligible.

Some immigrants qualify for a stimulus check if they meet the eligibility criteria and have a valid Social Security number. Immigrants with green cards or H-1B and H-2A work visas are eligible for a check. Nonresident aliens, temporary workers and immigrants in the country illegally aren't eligible.

But mixed-status households, or those where a family member doesn’t have a Social Security number but others do, will be eligible for stimulus payments, a key change from the CARES Act. Under that legislation, households that had a single member without a Social Security number were disqualified from receiving a payment.

The latest measure, however, would allow U.S. citizens who are married to foreign nationals without Social Security numbers to receive the aid.

To get the extra $600 for a qualifying child, he or she must also have a Social Security number.

| World news today: India's COVID-19 tally surpasses China, becoming Asia's biggest epicenter World news today May 16: With one-day rise reaches over 4,000 cases in the last few days, India's COVID-19 tally tops nearly 82,000 as of ... |

| Second round of coronavirus stimulus checks, what we should know Following a direct check of US$1,200 to millions of Americans impacted by the coronavirus pandemic, the Trump administration has recently unveiled a US$3 trillion relief ... |

| U.S. Citizens whose spouse is an immigrant are blocked from getting Stimulus Checks Trump blocks stimulus funding for millions of US citizens married to immigrants,who file taxes jointly with a spouse lacking a Social Security number denied COVID-19 ... |

Recommended

World

World

Thailand Positions Itself As a Global Wellness Destination

World

World

Indonesia Accelerates Procedures to Join OECD

World

World

South Korea elects Lee Jae-myung president

World

World

22nd Shangri-La Dialogue: Japan, Philippines boost defence cooperation

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World