Strategy for Steel Industry: Challenges and Opportunities

Many shortcomings to overcome

Speaking at the seminar’s opening, Dr. Nguyen Van Hoi - Director of the Vietnam Institute of Strategy and Policy for Industry and Trade said that the Institute was assigned the task of building a strategy to develop Vietnam's steel industry to 2030, with a vision to 2050. In the coming time, the Institute will make efforts to speed up the progress of developing a strategy to complete the draft, which is expected to be reported to the Ministry of Industry and Trade for submission to the Government in the second quarter of 2024.

|

| Seminar "Strategic orientation for the development of Vietnam's steel industry to 2030, with a vision to 2050." (Photo: congthuong.vn) |

Do Nam Binh (Vietnam Industry Agency) shared his thoughts about the highs and lows of Vietnam's steel industry.

"Although Vietnam's steel industry has made many improvements in recent times, localities, as well as steel businesses, have been quite confused without a systematic investment plan to develop the steel industry. Therefore, the development of the steel industry still has many shortcomings. Typically, besides large steel factories invested in new technology, there are still many old steel factories with a capacity of less than 500,000 tons per year with outdated technology that consumes a lot of raw materials, causing environmental pollution, and poor competitiveness."

Regarding production capacity, the Vietnam Industry Agency also said that by 2023, the country's steel billet production capacity has been about 28 million tons/year, of which hot rolled coil steel (HRC) has been 7-8 million tons/year, construction steel (about 14 million tons), ensuring 100% for domestic consumption demand and partly for the export market.

|

| Do Nam Binh from Vietnam Industry Agency. (Photo: congthuong.vn) |

Green transformation is an inevitable trend

Regarding improving competitiveness, Do Nam Binh also said that iron and steel production is one of the industries greatly affected by the carbon border adjustment mechanism (CBAM). This policy will be piloted and applied transitionally from October 1, 2023. The CBAM mechanism has been piloted by the European Union (EU) for a transition period from October 1, 2023 and fully implemented from 2026.

Currently, the EU is one of the top export markets of Vietnam's steel industry. If Vietnamese steel enterprises do not respond well to CBAM, exports to the EU will be affected, with a greater risk of losing more markets when these countries are considering applying regulations similar to CBAM.

Therefore, Binh recommended that domestic steel-producing companies must convert production towards "green" to improve competitiveness.

At the seminar, Pham Cong Thao, Deputy Director General at Vietnam Steel Corporation - Vice Chairman of Vietnam Steel Association said: Currently, developed countries are building a green development roadmap. This is also a major barrier and challenge in Vietnam's steel exports. Currently, Vietnam has also made a commitment to be carbon neutral by 2050.

Thao admitted that Vietnam's steel production is behind many countries, lacking and weak in technology. Therefore, the Vietnamese steel industry also wants the Government to provide specific support and guidance on production technology for businesses in green production.

|

| Pham Cong Thao, Deputy Director General at Vietnam Steel Corporation - Vice Chairman of Vietnam Steel Association (Photo: congthuong.vn) |

Strengthening barriers with imported steel

At the seminar, Tran Thu Hien - Legal Director of Hoa Phat Group said that Hoa Phat Group's total capacity will reach 14 million tons when Hoa Phat - Dung Quat Steel Factory phase 2 is completed and comes into operation. Hien recommended that to ensure the development of the domestic steel industry, it is necessary to build stricter technical barriers with steel imported into Vietnam.

Currently, countries around the world are increasingly applying technical barriers and trade defense measures to protect domestic manufacturing industries. Technical barriers are clearly applied in countries such as Thailand, Indonesia, Malaysia, Korea, India, Australia, UK. Specifically, products exported to these countries require a certificate of compliance with the importing country's quality standards for products that meet the importing country's standards. The goal of these licenses is to prevent the import of poor-quality products and strengthen control over imported steel.

Meanwhile, almost steel products imported into Vietnam have an import tax of 0%. Furthermore, trade defense measures such as steel billet defense have been removed, and other steel products such as galvanized steel sheets, color steel sheets, steel pipes, and pre-stressed steel are not subject to any trade remedy measures.

At the same time, steel products are not included in the list of Group 2 according to the decision of the Ministry of Industry and Trade, so they are not subject to specialized inspection of product quality.

Therefore, the import of steel products into Vietnam does not have a quality inspection process like other countries, leading to imported steel that is diverse in type and quality and has not been assessed for conformity with Vietnamese standards, and there is no control on quality and type.

At the discussion, steel businesses all agreed with the proposal to consider building processes and procedures for checking the quality of steel imported into Vietnam. Accordingly, imported steel needs to have a certificate of compliance with Vietnam's quality standards before importing. Also, authorities need to strengthen investigations and apply appropriate trade defense measures to limit unfair competition in steel products and protect the domestic steel industry.

| Iron and steel exports witnessed a growth in the first two months of 2021 Vietnam's iron and steel exports industry have enjoyed a rapid growth of 71,9% in first two months of 2021, compared to the same period of ... |

| Vietnam earns $1.82 billion from iron and steel exports in first quarter 2021 The Vietnamese iron and steel sector enjoyed a strong bounce-back after recording an impressive growth of 65.2% in export value, earning $1.826 billion during the ... |

| Making of a monument: creator of Fansipan's stainless steel peak revisits mountain summit The 20-kilogram stainless steel pyramid block still stands and shines on the peak of Fansipan, 13 years after being built |

Recommended

Focus

Focus

Vietnam Leaves Imprints on the World Peacekeeping Map

Friendship

Friendship

VUFO Attends Fourth Dialogue on Exchange and Mutual Learning among Civilizations

Focus

Focus

Strengthen Solidarity and Friendship Between Vietnam and Venezuela

Friendship

Friendship

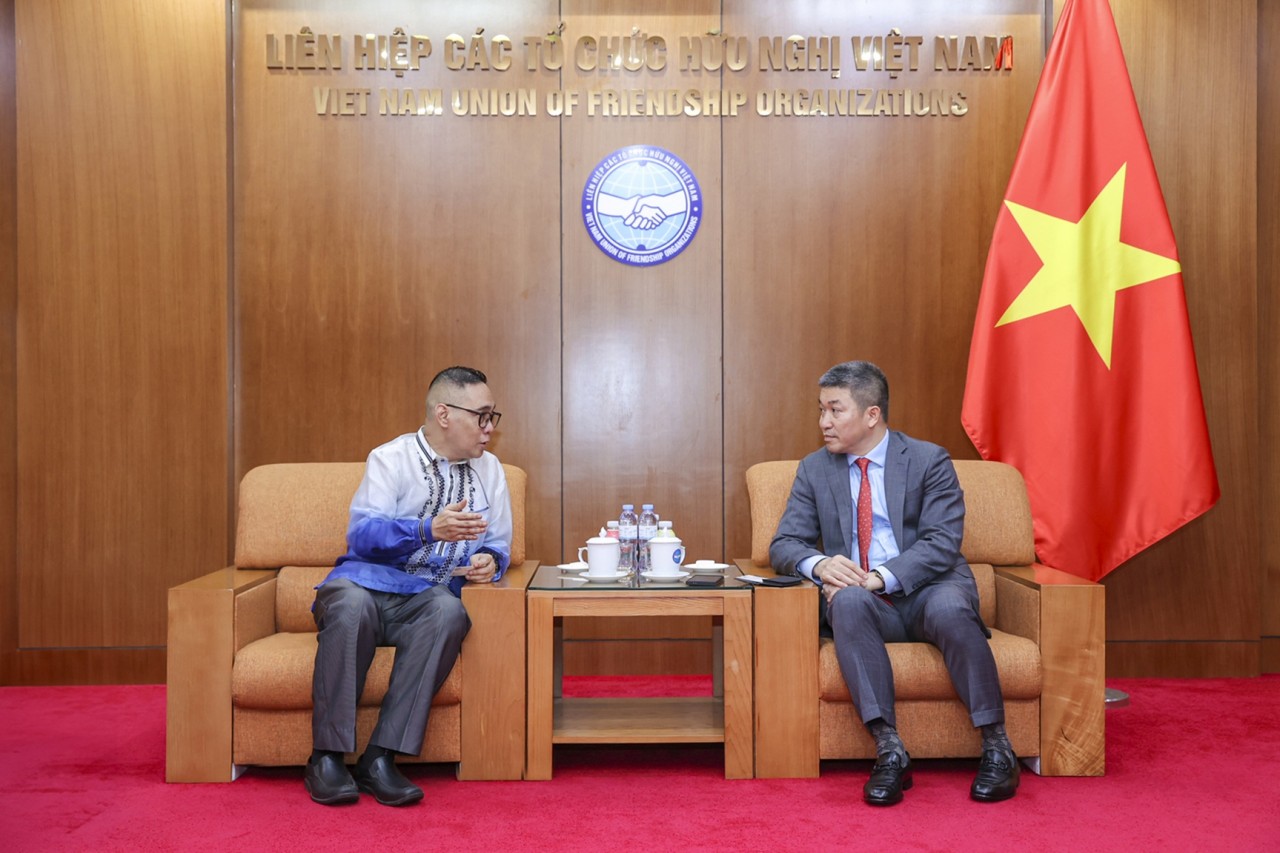

VUFO Supports Initiatives to Enhance People-to-people Exchanges between Vietnam and the Philippines

Focus

Focus

"Vietnamese - Cuban Children, Deep Friendship" Painting Contest Announces Winners

Focus

Focus

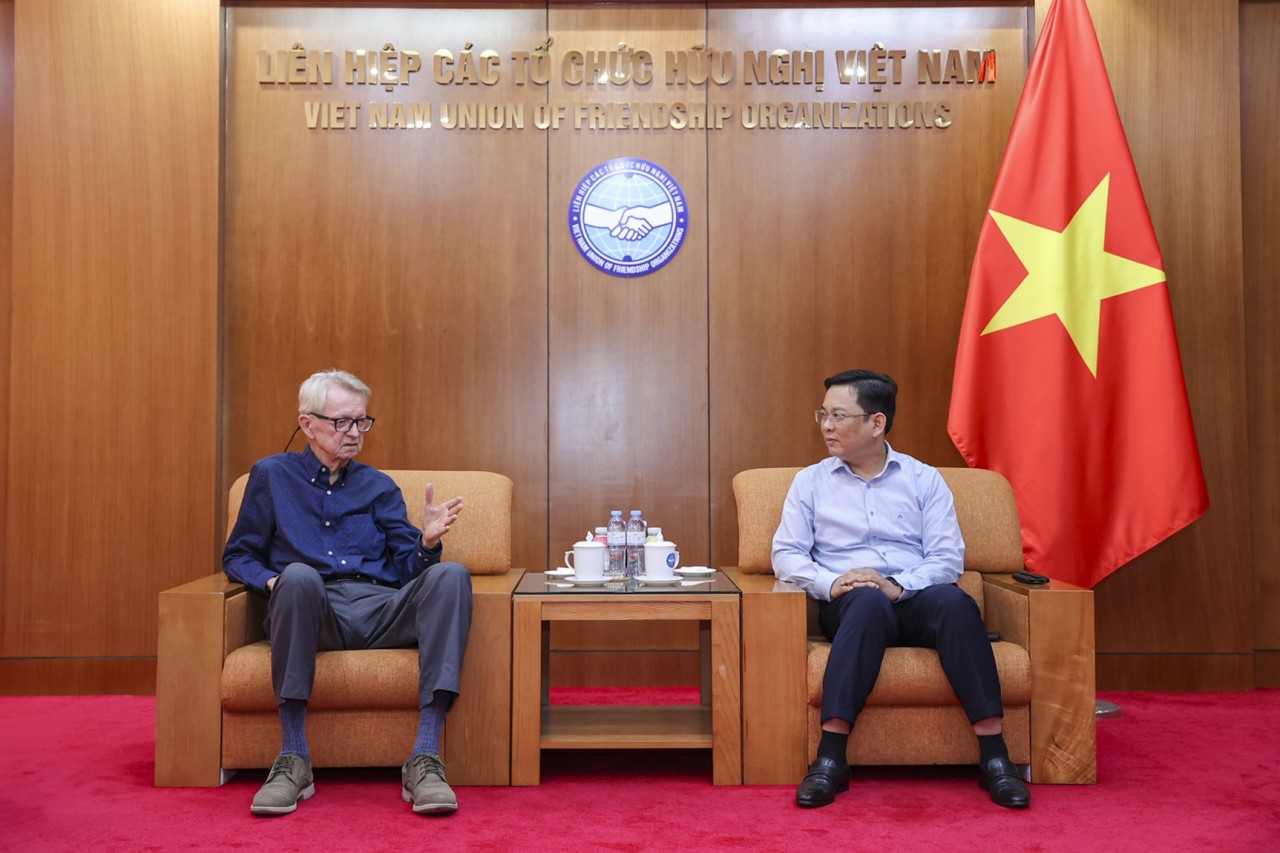

Solid Bridge for People-to-people Relations between Vietnam and Germany

Focus

Focus

35 Years of FES in Vietnam: Fostering Dialogue, Advancing Equity

Friendship

Friendship