Vietnam’s Biggest Investors Expect Further Gains Amid Pandemic, Bloomberg Says

|

| Graph: Bloomberg |

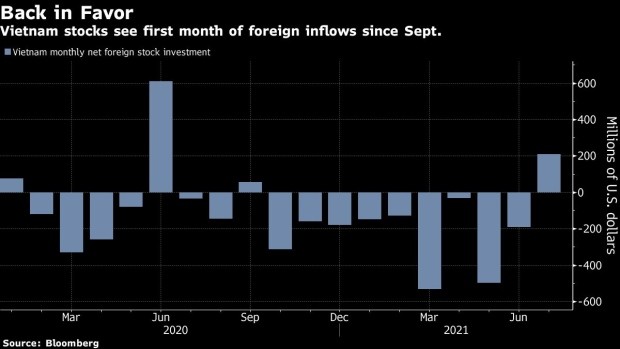

“Vietnam’s nascent stock rebound could push on to fresh highs thanks to cheap valuations and a positive earnings outlook,” Bloomberg cites two biggest equity investors in Vietnam.

It quotes the opinion of Bill Stoops, chief investment officer at Dragon Capital Group Ltd., which says the VN Index may advance another 10% to 1,500 points provided that Covid-19 vaccinations curb new virus cases in coming weeks.

Manager of VinaCapital Group’s statement is also highlighted, which says Vietnam is VinaCapital Group, favoring real estate and consumer companies.

The 7% slump in the benchmark gauge last month -- the worst since March 2020 -- triggered a bout of bargain hunting by global funds, which became net buyers for the first time in 10 months. Its performance mirrors that of other equity gauges, such as India and Australia, where investors are betting the recent wave of infections will come under control while policymakers continue to support the economy.

|

| Photo: Vietnam Insider |

If Vietnam can control the outbreak, it will “get back on track to where it was before this fourth wave,” said Stoops, who expects earnings on the benchmark to jump 45% this year. The VN Index hit an all-time high of 1,420 in July before pulling back.

Stoops is bullish on banks, property and steel stocks as well as retail and technology firms like Mobile World JSC and FPT Corp.

Despite facing its worst Covid-19 outbreak yet, Bloomberg said, the VN Index is still up 23% for the year, Asia’s best performing major stock gauge.

|

| A man has his temperature check at a supermarket entrance, during the outbreak of the coronavirus disease in HCMC. Photo: Reuters. |

Bloomberg-compiled data shows the index’s forward price-to-earnings multiple, which is at 14 times, is below its five-year average of 14.5 times

“Vietnam continues to manage the outbreak far more effectively than many other countries in the region, from both a public health and economic standpoint,” said VinaCapital’s chief investment officer Andy Ho. “The current outbreak may have disrupted the pace of growth, but it has not derailed it.”

| Vietnam Aims to Boost Digital Economy to 20% of GDP in Four Years, Says Bloomberg Between 2016 and the first half of 2020, investors funneled $1.9 billion into Vietnam’s online sector, according to a study by Alphabet Inc.’s Google. |

| BNN Bloomberg: solar surges in Vietnam Solar power in Vietnam has experienced a 100-fold increase over the past two years, according to BNN Bloomberg, Canada's business news network reporting on finance ... |

| Bloomberg: Vietnam’s Masan exploring options for animal feed unit Masan Group Corp. is exploring options for its animal feed unit that could include selling a stake to a strategic partner. It is seeking to ... |

Recommended

Economy

Economy