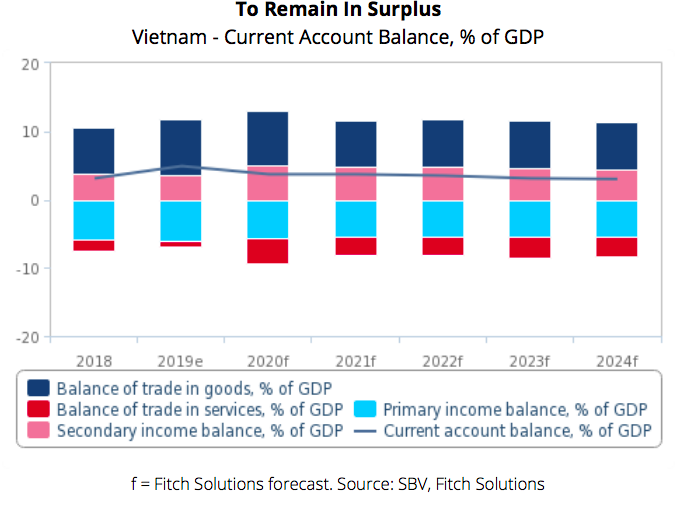

Vietnam's current account surplus is predicted at 3.7% in 2020

| Vietnamese agro-forestry-fisheries trade surplus reached US$6.2 billion | |

| Vietnam's trade surplus reached US$10 billion by mid-August | |

| Vietnam’s trade surplus reaches USD 10 billion |

This would mainly be due to the drop in tourism causing a sharp fall in the services trade balance, according to a recent report on Vietnam’s outlook of Fitch Solutions.

"We expect the collapse in tourism as a result of COVID-19 induced travel restrictions to cripple services exports," Fitch said in a statement.

|

| Foreign tourists visit Hue Imperial Citadel in the central province of Thua Thien-Hue Photo: VNA |

"Indeed, following border closures, tourist arrivals have fallen significantly from generally above a million every month to below 30,000 from April to July."

Meanwhile, Fitch said, the primary income deficit was likely to narrow slightly on the back of Vietnam’s economic growth outperformance relative to the global economy, which will support profits for foreign investors and by extension, the income paid abroad.

The external goods trade balance is likely to remain fairly stable, considering the high composition of intermediate goods in Vietnam’s imports for use in export manufacturing, which see both exports and imports track each other closely.

|

| Vietnam-Current Account Balance, % of GDP Source: SBV, Fitch Solutions |

Fitch Solutions forecast Vietnam to record real GDP growth of 3.0% in 2020, and the global economy to contract by 4.0%.

The primary income deficit is likely to narrow slightly. This is because Vietnam, having transformed into an export hub and being a strong beneficiary of supply chain diversification trends from China, should continue to experience resilience in exports over the year.

Vietnam’s multitude of free trade agreements, favorable business, and labor environment help it grow its market share of global exports despite a fall in aggregate global demand, Fitch Solutions explained.

This should support the returns for foreign businesses that have set up export manufacturing sites in Vietnam, and their associated investment income remitted back home. Accordingly, Fitch Solutions forecast only a 5% fall in primary income payments abroad to about US$17 billion, but a 33% fall in receipts to US$1.5 billion due to a weak economic environment externally.

Fitch Solutions expected the positive goods trade balance to offset the sum of the services trade deficit and net primary income payments. Finally, Covid-19 grants from multilateral organizations such as the World Bank and other transfers from overseas persons and entities should keep Vietnam’s secondary income balance positive as it has been since 2012.

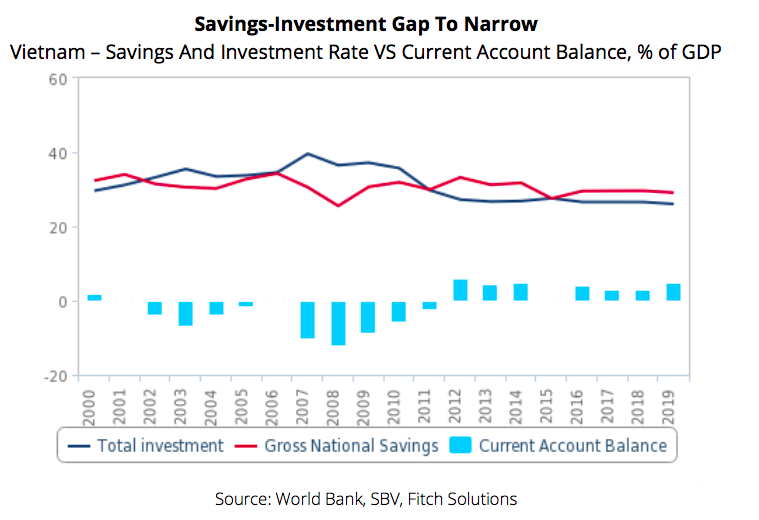

Current account to remain surplus in next decade

|

| Vietnam-Savings and Investment Rate Vs Current Account Balance, % of GDP Source: World Bank, SBV, Fitch Solutions |

From a savings-investment perspective, Vietnam’s negative savings-investment gap flipped positive since 2011, correspondingly seeing the current account post surpluses thereafter.

Since then Vietnam has been a net direct investor overseas and Fitch Solutions expected this current account surplus to continue but narrow over the coming decade.

Risks to Vietnam’s external financing position will remain low over the coming decade. Vietnam’s foreign reserves, at US$82.84 billion as of May 2020, represents four months of import cover.

|

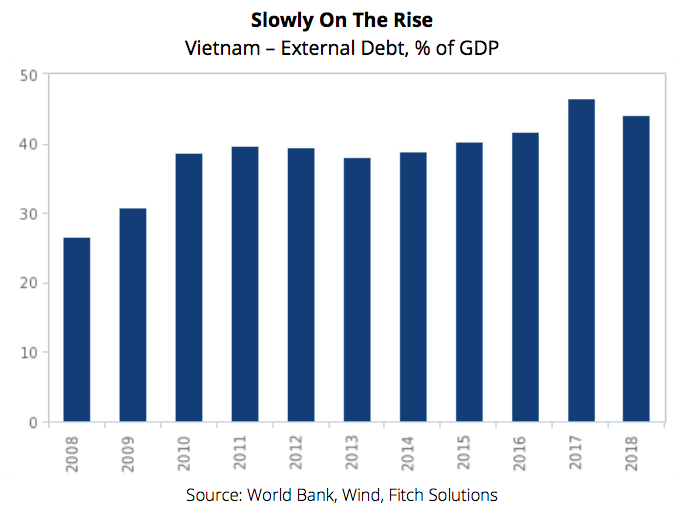

| Vietnam-External Debt, % of GDP Source: World Bank, Wind, Fitch Solutions |

While this may appear to just cover the minimum of three months required, Fitch Solutions flagged that Vietnam’s reserve position is actually stronger than it seems. This boils back to the fact that Vietnam’s imports comprise largely of inputs for exports. If focused on only imported goods for local demand, the figure would be almost eight months of import coverage.

Additionally, there are limited risks from Vietnam’s growing external debt burden. According to World Bank data, Vietnam’s external debt level was at 44% of GDP in 2018 and has been on an uptrend since 2008 when it was 27% of GDP. Given that more than 80% of total external debt is in the form of long-term debt, Fitch Solutions did not see major risks stemming from the need for high debt repayments over the short term, especially considering the low-interest-rate environment the world has been in for the past decade.

| Trade surplus in Vietnam reaches record in seven months Vietnam's trade balance reached USD 2.77 billion in July, lifting total trade surplus to USD 8.23 billion in the first seven months of 2020, according ... |

| Vietnam's trade surplus in 7 months reached US$6.5 billion In July, Vietnam enjoyed a trade surplus of estimated US$1 billion. This brought the trade surplus in 7 months to reach US$6.5 billion, much higher ... |

| Vietnam achieved trade surplus of USD 4 billion in the first six months Data from the General Statistics Office (GSO) revealed that Vietnam reported a trade surplus of USD 4 billion during the first six months of 2020, ... |