Gold price hits 4-month low as vaccine progress slams precious metals

|

| Gold fell to its lowest in four-months on November 25. Photo: internet |

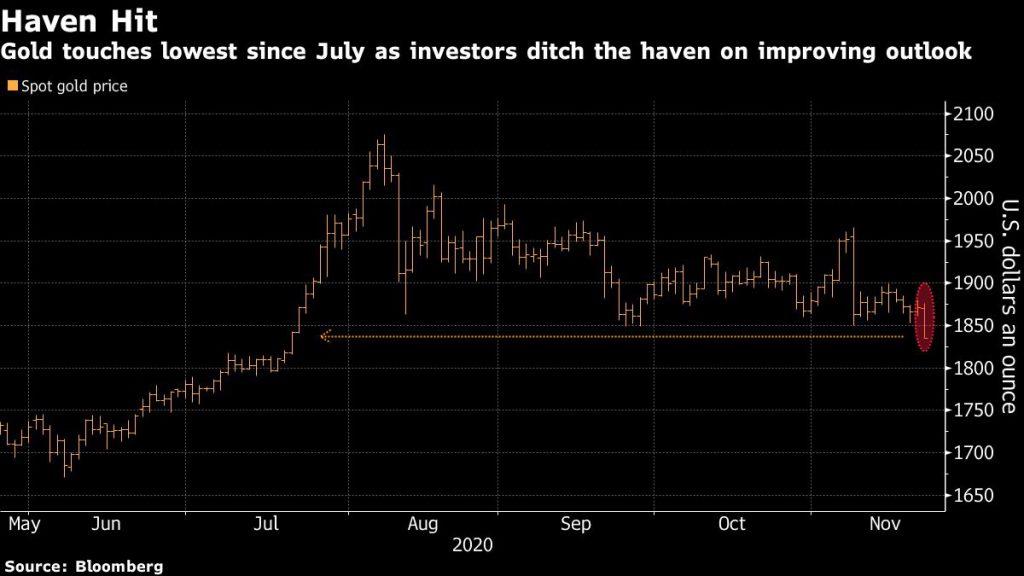

Gold fell to its lowest in four-months on November 25 as growing optimism over a covid-19 vaccine and signs of recovery in the US economy drove investors away from the safe-haven metal and towards riskier assets.

December gold futures last traded at US$1,809.50 an ounce on the day, according to kitco.com.

Bullion extended last week’s loss after AstraZeneca said its vaccine prevented most people from developing the coronavirus, marking another promising development in the quest to end the pandemic.

Meanwhile, US business activity powered ahead in November at the fastest pace since March 2015, IHS Markit figures showed.

Gold prices have already posted two straight weekly declines, and holdings in exchange-traded funds backed by the metal have slipped recently as hopes for a vaccine buoyed markets and curbed demand for haven assets, according to mining.com.

|

| Gold price hits 4-month low. Source: Bloomberg |

Gold’s break below $1,850 triggered a wave of sell stops, according to Phillip Streible, chief market strategist at Blue Line Futures in Chicago.

“Gold prices broke through technical support, catalyzing a rush to the exits,” Daniel Ghali, a TD Securities strategist, echoed the same sentiment.

“For weeks, capital outflows from ETFs have added pressure to gold markets as a second wave sweeps across the globe, keeping inflation expectations capped, while the vaccine announcements have also seen safe-haven flows reverse,” Ghali added.

“Gold broke below the key $1,850 level after an unbelievably strong US PMI release just dampened the need for stimulus. No one was expecting such strong readings in both services and manufacturing,” Edward Moya, senior market analyst at OANDA, told Reuters.

Gold, traditionally considered a hedge against inflation and currency debasement, has gained over 21 percent this year, benefiting from the economic damage from the pandemic and the ensuing global stimulus measures.

|

| Gold prices experience sharp fall. Photo: Vietnamnet |

Meanwhile, in the domestic market, Saigon Jewelry Company listed the price of SJC gold at VND55.05 million per tael for buying and VND55.5 million per tael for selling, down by VND570,000 per tael for both buying and selling rates at 4 p.m. in Ho Chi Minh City.

At the same time in Hanoi, Bao Tin Minh Chau Company quoted SJC gold at VND55.1 million per tael for buying and VND55.5 million per tael for selling, down VND650,000 per tael in buying rate and VND520,000 per tael for selling./.

| Gold price today Aug 18: Rallies 2% and challenges $2,000 per ounce once again After witnessing a fall to the mat last week, the gold market has resurged and challenged the level of $2,000 per ounce, according to Kitco. |

| Gold prices slip in both domestic, foreign markets, showing signs of economic recovery Gold prices slide in both domestic and foreign markets on August 16, making Vietnamese gold buyers lose more than VND 5 million (USD 216.4) per ... |

| Gold Price Forecast: Gold Prices could retest support near $1,660 in September Gold price collapsed to $1,874.20 on Wednesday after days of thriving and experts forecast that the precious metals prices could Reach $1,660 in September, which ... |