Guide to personal income tax for foreigners in Vietnam 2021

| New decree issued for foreign employees in Vietnam | |

| New policy in Vietnam on management and use of ODA and preferential loans | |

| Decree 20 has impact on property sector |

|

According to the tax regulations, an individual is regarded as a Vietnamese tax resident if he/she is:

- present in Vietnam for 183 days or more in a calendar year or in 12 consecutive months from the first day they arrive in Vietnam; or

- having a permanent place of residence in Vietnam, particularly:

- the place which has been registered and reflected on the permanent residence card or temporary residence card of the individual;

- having a leased house or similar, i.e. hotel, guest house, location of office in Vietnam with total lease term of 183 days or more in a tax year and not being a tax resident of jurisdictions other than Vietnam.

1.Personal Income Tax Rates in Vietnam

The tax rates for personal income tax in Vietnam depend mainly on your residency status as well as types of income.

Personal Income Tax Rates in Vietnam for Tax Residents

For employment income, Vietnam applies progressive tax rates if you are a tax resident. Please look at the table below to see the specific rates imposed on different parts of income amount:

Monthly Taxable Income (VND) Tax Rate

Up to 5 million 5%

Above 5 to 10 million 10%

Above 10 to 18 million 15%

Above 18 to 32 million 20%

Above 32 to 52 million 25%

Above 52 to 80 million 30%

Above 80 million 35%

For business income (yearly revenue below 100 million is not deemed as business income), the tax rates vary based on sectors:

Distribution and supply of goods 0.5%

Service or construction without the supply of raw materials 2%

Lease of assets, re-sales of insurance, lottery or goods 5%

Manufacture, transportation, services attached to goods, construction with the supply of raw materials 1.5%

Other sectors 1%

For other types of income, the tax rates are described as follows:

Dividend/Capital Investment Income 5%

Royalties or Franchising Income 5%

Income from Prize-Winning 10%

Income from Inheritance or Gift 10%

Income from Capital Transfer 20% on net gain

Income from Share/Stock Transfer 0.1% on sales proceeds

Income from Real Estate Transfer 2% on sales proceeds

2. How to Reduce Personal Income Tax in Vietnam

2.1 Family Circumstance Deduction

According to The Resolution No.954/2020/UBTVQH14 released by the government, it is regulated that from 1st July 2020:

As a taxpayer, you can automatically deduct 11 million VND (around US$471) per month from your taxable business income or employment income, and

For each dependant, you can further deduct another 4.4 million VND (around $US188) per month from your taxable income.

However, you need to register and provide supporting documents to the local tax authority to confirm that the dependant is qualifying for the deduction policy. Qualifying dependant may be children below 18 years old, spouse, or parents who are unable to work or have low income.

The law on personal income tax in Vietnam also states that taxpayers who have difficulty in paying tax due to natural disasters, accidents, or rare illnesses may be considered to reduce the amount of payable tax (determined by the tax authority).

2.2 Donation Deduction

Furthermore, you can deduct from your taxable business or employment income an amount equivalent to your contribution to:

Approved organizations that raise or take care of children with difficulties, the disables, and the elders; or

Certain approved charities.

Additionally, section 21 the document No.15/VBHN-VPQH also states that payments for compulsory social security contributions like Health Insurance, Unemployment Insurance, or Social Insurance can also be deducted from taxable income.

3. Tax Declaration and Payment

For employment income, personal income tax needs to be declared and paid on a monthly basis (within 20 days after a month ends) or on a quarterly basis (within 30 days after a quarter ends). Normally, organizations or persons that pay income which is subject to personal income tax are responsible for this task.

The total paid amount will then be reconciled to the year-end tax finalization. An annual tax return must be submitted within 90 days after the tax year ends and all remaining tax amount needs to be paid within the same period.

For non-employment income, the time for tax declaration and payment varies based on each type of income. Normally, it follows a receipt basis.

Foreign-invested enterprises have to conduct personal income tax finalization on behalf of their employees. And foreigners are also required to carry out personal income tax finalization on their labor contract terminations in Vietnam before their departures.

Original story version:

https://bbcincorp.com/resources/personal-income-tax-in-vietnam

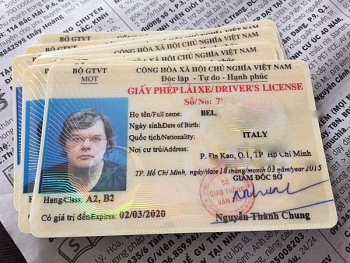

| How to get (convert/renew) Vietnam driving license for expats There is an exponential increase in motorbikes in Vietnamese cities in recent years. People are more financially stable to afford a motorbike lately in Vietnam. ... |

| Decree 20 has impact on property sector The implementation of Decree 20/2017/NĐ-CP (Decree 20) has affected the production and business activities of enterprises, especially in the real estate sector. |

| Decree No. 82/2015/ND-CP: Visa exemption for overseas Vietnamese visitors Decree No. 82/2015/ND-CP on visa exemptions for Vietnamese people and foreigners who are spouses and children of Vietnamese people settling abroad or of Vietnamese nationality ... |

In topics

Handbook

Handbook

A Japanese decides to retire early to visit Vietnam 10 times a year to unknown areas

Viet's Home

Viet's Home

Three Irish youngsters tell about life in safe haven of Vietnam amid COVID-19

Recommended

Viet's Home

Viet's Home

“Global Vietnamese Singing 2025” - Connecting Hearts Longing for Homeland

Viet's Home

Viet's Home

Vietnam’s People's Public Security Force Actively Contributes to UN Peacekeeping Operations

Viet's Home

Viet's Home

HAUFO Enhances Competence of People-to-People Diplomacy Personnel

Viet's Home

Viet's Home

Hands that Reserve Da Long Brocade Craft

Popular article

Viet's Home

Viet's Home

Da Rsal – How Digital Transformation Reshape a Poor Commune

Viet's Home

Viet's Home

Vietnam Classified as “Low Risk” Under the EU Anti-Deforestation Regulation

Viet's Home

Viet's Home

Vietnamese Architect Wins the Diversity in Architecture Award 2025

Viet's Home

Viet's Home