Huyndai Motor's May sale witnessing fall sharply amid Covid-19 pandemic

| Global automotive yield may fall 20% due to Covid-19 | |

| Huyndai Glovis opens first SE Asia office in Vietnam | |

| Car sales increase 58 percent over last year |

Huyndai Motor’s sales fell sharply in May

According to Reuters, South Korea’s Hyundai Motor Co said on Monday its provisional May sales fell 39% year-on-year to 217,510 vehicles globally, as the coronavirus outbreak continued to hit demand in key markets.

Sales were, however, up about 30% from 167,693 vehicles in April. Its domestic sales rose 5% year-on-year, led by popular models such as the Grandeur sedan and new models such as all-new Elantra and premium brand Genesis’ G80 sedan.

|

| An employee wearing a mask to prevent contracting the coronavirus disease (COVID-19) waits for custormers next to a Hyundai Motor's vehicle at Hyundai Motor Studio in Goyang, South Korea, April 21, 2020. Photo: REUTERS/Kim Hong-Ji. |

However, overseas sales fell 50% on year due to weak auto demand from slowing economic activities stemming from COVID-19, the automaker said in a statement.

South Korea’s May auto exports fell 54% on year despite the sequential resumption of sales at dealerships in major countries, due to increased inventory from low sales in the previous month and decreased demand in major markets such as the U.S. and Europe, the trade ministry said in a separate statement on Monday.

Hyundai Motor’s sister company Kia Motors announced provisional May sales of 160,913 vehicles, down 33% from a year ago, while its domestic sales rose 19% on year, overseas sales fell 44%. Together, they are the world’s fifth-largest automaker.

|

| South Korean car production is shrinking as sales slide in the country's major export markets, squeezing profitability for auto parts suppliers. Photo: Hyundai Motor. |

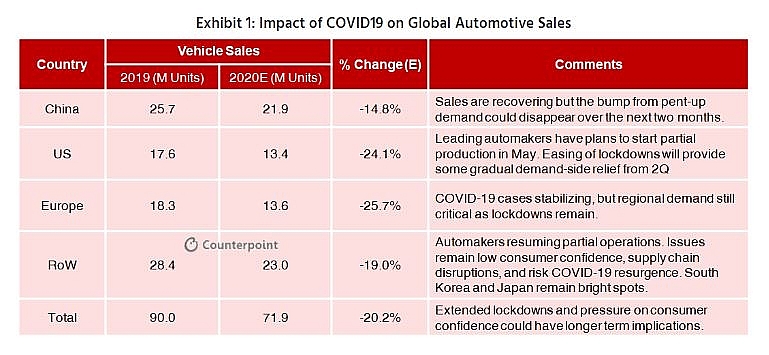

Covid-19 impacts on global automotive industry

Coronavirus (COVID-19) Pandemic emerged around the end of December 2019 at Wuhan, Hubei province, China. The pandemic is having a major impact on all aspects of industries, including automotive sector, with major manufacturers either totally shut down following the directives issued by local governments or are running with minimal staff at production units to keep their personnel safe, Globenewswire reported.

|

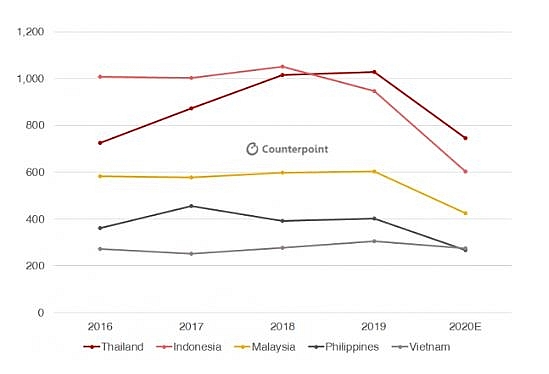

| ASEAN5 Vehicle Sales, 2016-2020E, ‘000 Units. Photo: counterpointresearch.com |

Manufacturing units around the world have been shut down, footfall in showrooms have fallen sharply, and vehicle sales have taken a huge hit. For the already struggling automotive industry, the global economic trade impact of Covid-19 pandemic on the automotive industry is estimated to be around $ 5.7 billion with European Union the worst-hit region at a US$2.5 billion decline in the automotive industry due to disruption in automotive supply chain amid a reduction in supplies from China.

Major automotive events across the globe are either being canceled or postponed, notably the 2020 Geneva motor show, Qatar Grand Prix, New York International Auto Show, and Australian Grand Prix. Major automotive players such as Fiat Chrysler Automobiles, Ford, PSA Group, Volkswagen Group factories in Europe, Ducati, Tesla factory in California, BMW group European factories, Rolls-Royce, General Motors are among the global automotive manufacturers who have suspended their production due to coronavirus.

|

| Photo: counterpointresearch.com |

Will supply chains be adjusted due to Covid-19?

Supply chains in the automotive industry are clustered in regional hubs, with the lion’s share of value-added (ie, the production of vehicles from component parts) happening close to the market. Even though inter-regional linkages contribute a smaller amount of value-added than those within regions, their disruption has been enough to cause major issues across the industry. The outages in Hubei province forced some factories elsewhere in the world to stop work weeks before those in other countries as China began lockdown measures to stop the community spread of the virus, think.ing reported.

|

| Inside Huyndai Production's line. Photo: onlineautoexpo |

The complexity of automotive supply chains makes it difficult as well as costly to make them more resilient to shocks. It is difficult to define how to mitigate the risks posed by future shocks that could happen within a country, region or, as with Covid-19, globally. With upwards of 10,000 suppliers in a vehicle’s value chain, organised across several tiers, there are further challenges in incentivising and enforcing de-risking comprehensively enough to cover all components.

|

| Workers assemble a Hyundai i10 car at a plant of Hyundai Motor India Ltd. Photo: onlineautoexpo |

Suppliers’ margins were being squeezed during the downturn in global economic activity before Covid-19, making the higher costs of increasing resilience unaffordable without raising prices. There is considerable work and expense involved in finding and retaining suppliers, that need to be able to produce to detailed specifications and meet quality and safety standards. Holding larger inventories is another way of increasing resilience by helping production to continue amid disruptions upstream in the supply chain, but involves higher storage and working capital costs.

| LATAM, the largest airlines in Latin America, files for bankruptcy According to a statement released on LATAM Airlines Group’s website, the largest carrier in Latin America, filed for Chapter 11 bankruptcy earlier this week. |

| Vietnam shrimp exports head to increase in May amid Covid-19 pandemic Vietnam shrimp exports in April experienced an increase of 5.8% to US$244.2 million, boosting the total export turnover during the opening four months of the ... |

| PM: Vietnam ready to be a long-term supplier of rice to the Philippines Prime Minister Nguyen Xuan Phuc held phone talks with President of the Philippines Rodrigo Duterte on May 26 to discuss bilateral and regional cooperation amid ... |

Recommended

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

Popular article

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World