Stock price today: Global stocks and US futures ruined as economic damage from coronavirus mounts

Global markets fall as investors take stock of the outbreak

|

Global stock markets fell moderately on Wednesday, as investors paused to assess the world’s response to the coronavirus outbreak, according to NY Times.

Most indexes in Europe were 1 to 2 percent lower, after a generally down day in Asia. Futures on Wall Street were wavering on how the trading session would open, one day after a rally fizzled.

Investors had in recent days found solace in signs that the outbreak was peaking in some of the hardest-hit parts of the United States and Europe. On Wednesday, China lifted its lockdown on the city of Wuhan, where the virus emerged, in another sign of progress.

But markets remain fragile. European Union leaders on Tuesday night failed to agree on financial tools to help countries in the bloc struggling with the pandemic, and new data forecast a deep recession in France and Germany. Meanwhile, Japan and South Korea this week joined other countries preparing big economic rescue packages.

Index indicates a volatile week

|

CNN’s analysis shows, Hong Kong's Hang Seng Index (HSI) fell 1.2% and China's Shanghai Composite (SHCOMP) dropped 0.2%, while benchmark indexes in Australia and South Korea also retreated. Japan's Nikkei (N225) bucked the trend, finishing with a gain of over 2%.

In Europe, France CAC 40 (CAC40) shed 1.8% in early trading, while Germany's DAX (DAX) lost 1%. The FTSE 100 (UKX) dropped 1.6% in London.

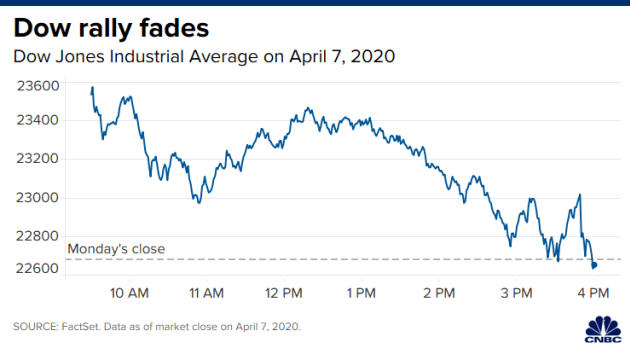

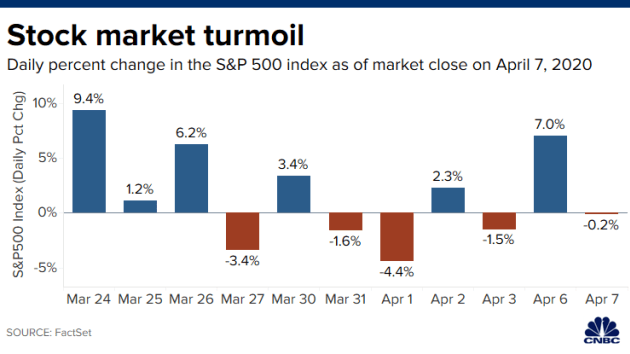

US stock futures were slightly lower after declines Tuesday on Wall Street. Dow (INDU), S&P 500 (SPX) and Nasdaq Composite (COMP) futures were all down by less than 0.2%.

Caution has once again taken hold as investors weigh the effects of the pandemic, said Jingyi Pan, a strategist for IG Group.

Germany's top economic research institutes said Wednesday that Europe's biggest economy is likely to shrink by 4.2% this year. It expects a contraction of 9.8% in the current quarter, which would be the sharpest decline recorded since record keeping began in 1970.

April’s economic data will be tough, Yahoo cited expert as saying

|

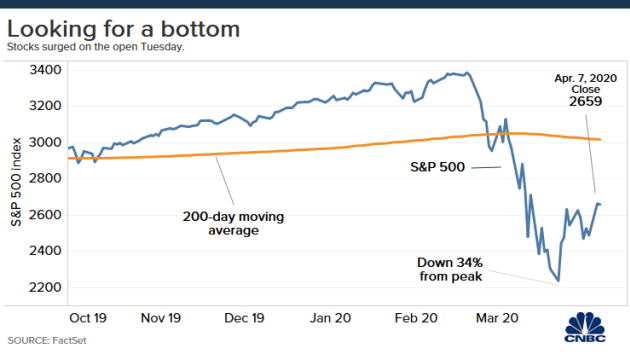

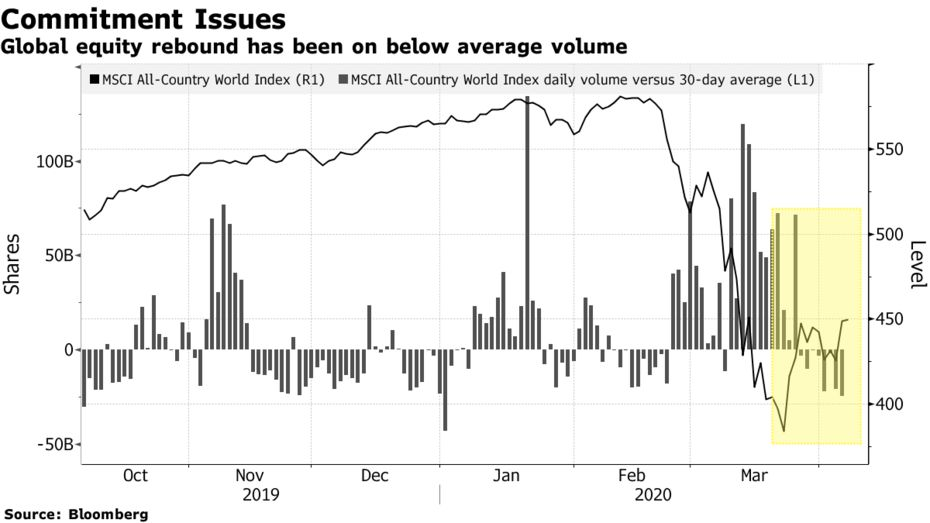

At the session highs on Tuesday, the S&P 500 rallied a total of more than 22% above its March 23 closing low, or 3.5% on the day, before ending the session slightly in the red.

Investors this week have been tracking mixed to slightly more positive developments in the coronavirus outbreak, with hotspots including New York and Italy showing improving trends in new cases and hospitalizations, even as new deaths for the Empire State rose by the largest number since the outbreak began.

Eight out of 10 U.S. counties are under some form of lockdown order amid the pandemic, according to a recent Wall Street Journal/Moody’s Analytics study, with the bulk of those seeing billions of dollars worth of lost output daily as businesses stay shuttered. And the impact of these shutdowns will soon be reflected in economic reports released in the coming weeks.

“April’s economic data will be a tough pill to swallow with monthly GDP [gross domestic product] likely contracting 50% at an annual rate,” Neil Dutta, head of economics at Renaissance Macro Research, said in an email Tuesday. “Next week, we get March retail sales and a couple of regional PMIs for April.”

| • S&P 500 futures (ES=F): down 1.25 points, or 0.05% to 2,640.75 • Dow futures (YM=F): down 18 points, or 0.08% to 22,473.00 • Nasdaq futures (NQ=F): down 5.75 points, or 0.07% to 8,006.25 |

| Vietnam stock market bounced back the highest single-day in 19 years The VN-Index surged 4.98 percent to 736.75 points Monday, saw its biggest single-day gain since October 10, 2001 after receiving good news of just one new ... |

| Stock prices today: Stock markets rise, US stocks futures move higher on coronavirus optimism Stock markets around the world on Tuesday maintained Wall Street’s Monday rally amid continued signs that the coronavirus outbreak may be peaking in a number ... |

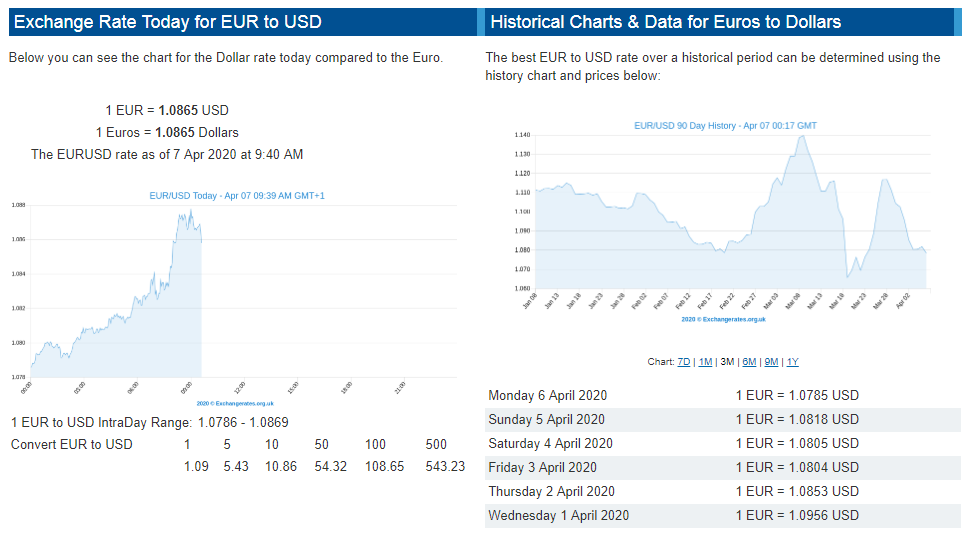

| Dollar exchange rate today: USD seems to be rallying on up-days in the stock market The US Dollar exchange rate seems to be rallying on up-days in the stock market, and Monday was no different as it handled the Euro ... |

Economy

Economy