Apple stock reached a new peak – Big win for Warren Buffett

| Will Apple arrive in Vietnam as its new nest? | |

| Apple fills key positions in Vietnam to open factory? | |

| Warren Buffett: 'Bet on America,' buying stocks |

The share price of all giant tech firms had risen simultaneously in the 6/7 trading day.

Especially, Apple share reached a new all-time peak of $374 per share, this makes Apple the biggest firm in terms of Capital Globally (US $1,640b).

Subsequently, 5.5% Apple share owned by Berkshire Hathaway is now being valued at $91b USD. This is also the most valuable single stock that Berkshire currently has in its portfolio, representing 43% of its total investment.

|

| Warren Buffett (source: CNN) |

Berkshire Hathaway holding is now retaining 245 million Apple shares in possession, making it the second biggest Apple shareholder.

The number 2 in Warren Buffett‘s portfolio is Bank of America, where he parked roughly US $22b of his fund, according to the closing price in 6/7.

Apple is the best company the world known of, according to Buffett. He even revealed that for him, Apple is not simply a stock, but the third separate business division of Berkshire Hathaway. For now, Berkshire Hathaway completely owned 2 companies, which are Geico Insurance and BNSF railways.

Before this point, all Top-of-the-list stocks plummeted deeply due to the effect of the Covid-19 pandemic. This leaves a loss of $50b to Berkshire Hathaway holding in the first quarter.

Most of the companies under Berkshire’s possession are “mildly to seriously” affected by the Covid-19 virus, with the range of decline from 5.2% to 34%. Meanwhile, BNSF railways and all retail companies are being forced to close.

| Back in May, Buffett said the fund has $137b of cash in its balance sheet. However, Buffett has “not done anything, because we don’t see anything that attractive to do”. |

|

| Dominion Energy (Source: AP image) |

There was a new deal announced recently, this is the first deal since the US got caught in the pandemic.

In this deal, the holding bought assets from Dominion Energy, specifically storage and transporting asset classes. Berkshire will pay $4b in cash and will take care of a sum of loans worth $5.7b from Dominion Energy. This deal, carrying an almost $10b price tag, is now pending for regulator’s approval and expected to close in the final quarter of this year

| New foreign investment wave begins in Vietnam despite Covid-19 Under the impacts of Covid-19 and the US-China trade tensions, the new wave of foreign investments into Vietnam has become more visible. Specifically, there have ... |

| Hanoi gets 36 investment offers worth US$ 26 billion Hanoi received 36 proposals for memorandums of understanding (MoU) for investment cooperation on June 23, which were estimated to be worth over US$ 26 billion. |

| Techtronic Industries to pour a US$ 650 million investment in Vietnam On Tuesday, the Vietnamese government revealed that Techtronic Industries has planned to invest an additional US$650 million in Vietnam to produce cordless appliances. |

Economy

Economy

Stock Price Today (July 11): Tesla stock is on the verge of becoming a 'Bubble'

Recommended

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

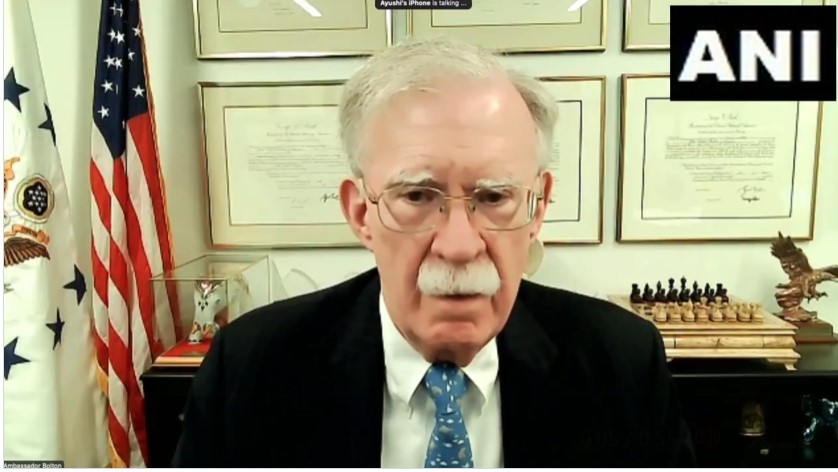

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World