Bitcoin price today: Bitcoin spikes by 2x in 26 days, correlation with Gold, S&P 500 strengthens unprecedentedly for 30 days

|

| Source: BTC/USD on Trading View |

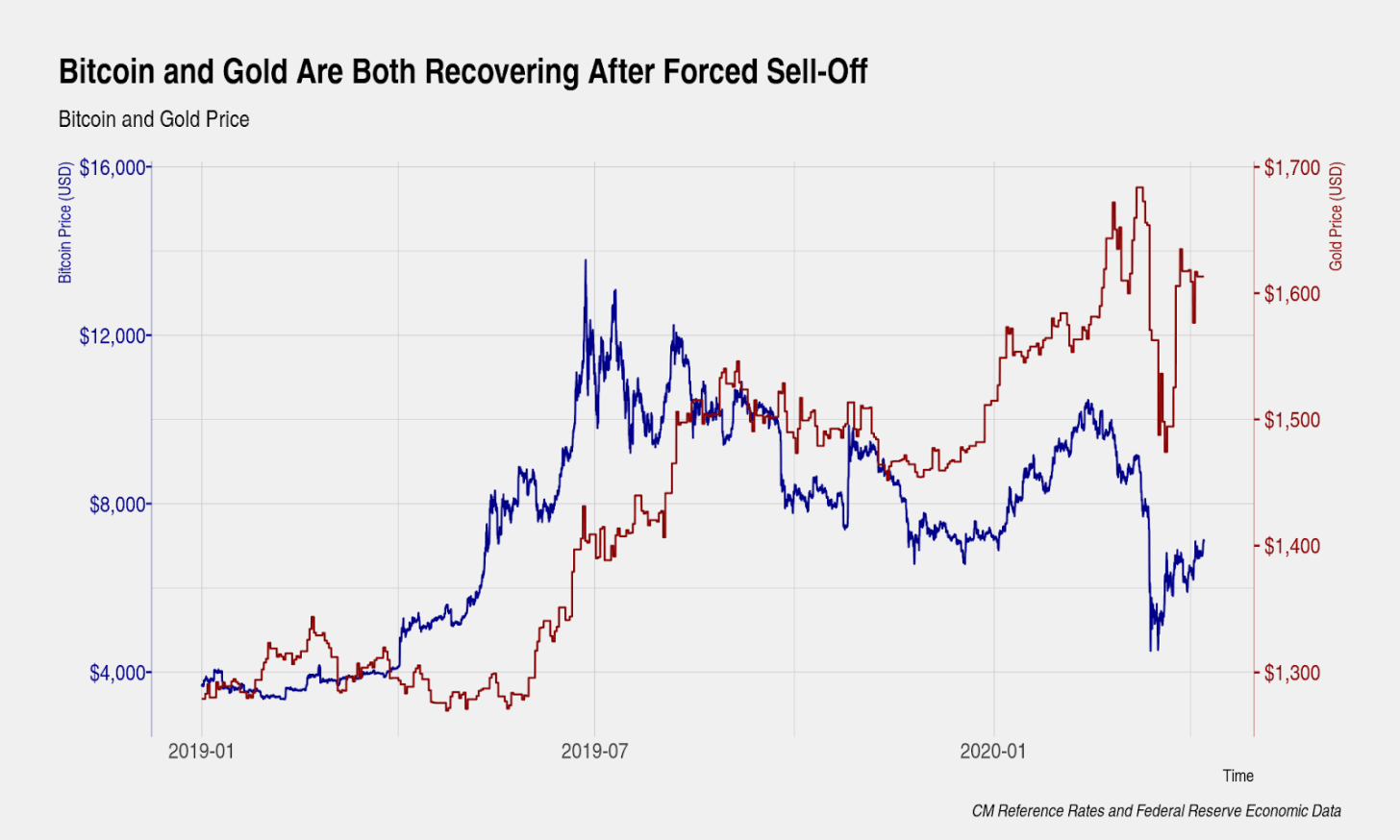

Bitcoin’s correlation with gold, measured over the past 30 days, is now at all time highs, latest report by Coin Metrics.

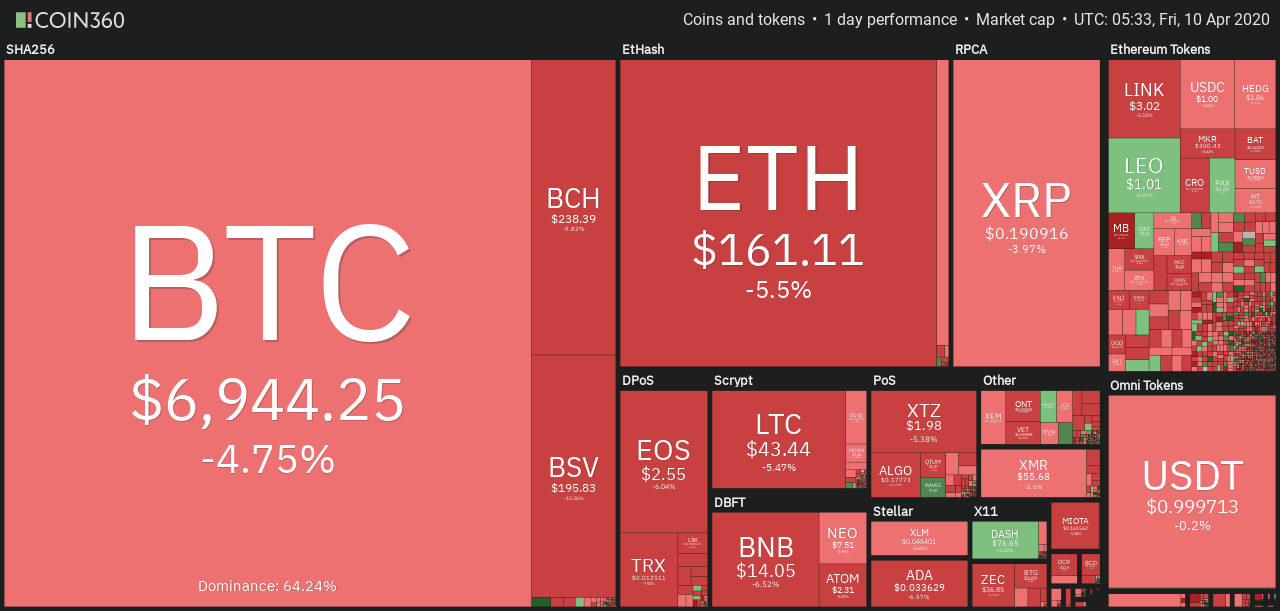

According to Ambcrypto, the price of Bitcoin found respite on the buyers’ shoulders, buyers who carried it from the shallows of $3,850 to $7,361.91, at press time. This 91.60% recovery in the price of the world’s largest cryptocurrency aligned with Bitcoin’s growing correlation with not only Gold, but with the S&P 500 too.

|

| Source: Coin Metrics |

Despite the much-debated “safe-haven asset” asset narrative, Bitcoin and Gold have seen their correlation improve; this, despite the world’s largest cryptocurrency observing an aggressive sell-off, along with the equities market and gold. The sell-offs in question resulted in both Bitcoin and Gold shedding a lot of their value, following which, the two asset classes started to bounce back.

As gold and digital gold continue to make their way up, their correlation was also observed to be on an incline.

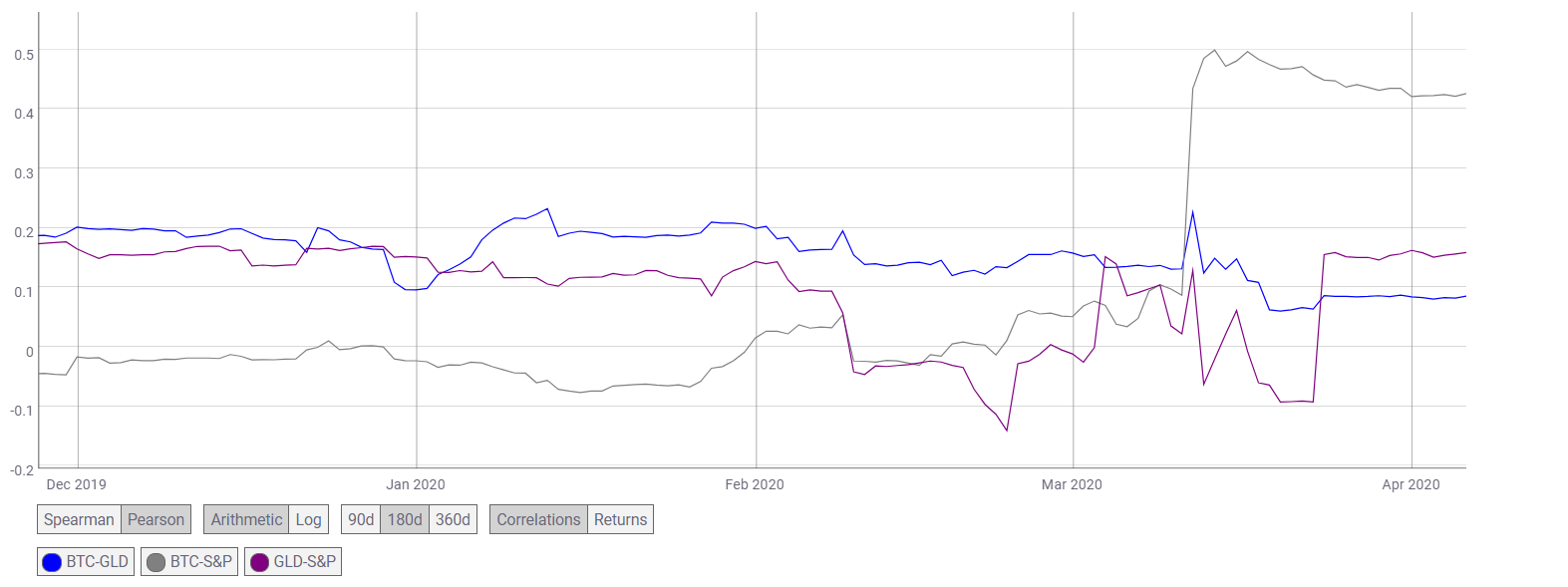

The rising correlation was also noted between SP-BTC and GLD-SP.

|

| Source: Coin Metrics |

In fact, according to market observer Santiment, the trifecta of Bitcoin [BTC], Gold [GLD], and S&P 500 [SPX], all recorded a positive correlation. This was notable as this was the first time in 2020 that all three were spiking upwards at the same time. Moreover, the correlation between Gold and S&P overtook the correlation between BTC and GLD, with the same having registered a significant spike towards the end of March.

It can be speculated that this was due to the rate cuts announced by central banks around the world, banks like the Reserve Bank of Australia and the U.S. Federal Reserve, in an effort to stabilize the domestic and global market. According to Fed Chairman Jerome Powell,

“We saw the risk to the outlook to the economy and chose to act.”

Following the announcement and the injection of $1.5 trillion to combat liquidity issues and boost economic activity, the market began to stabilize. However, the unprecedented monetary policy and fiscal stimulus initiatives by these countries might be accentuating the risk of severe financial imbalance. The potential long-term result of such plans could be inflation.

Bitcoin spikes by 2x in 26 days: What’s actually behind the big rally?

The Bitcoin (BTC) price has increased by two-fold in less than a month, surging from $3,600 to over $7,350. While traders believe a combination of many factors caused the upsurge, there are three main factors that likely contributed to it, Joseph Young of Coin Telegraph analyzed.

The three factors are a significant surge in spot buys, a massively overextended plunge below $4,000, and the immediate recovery of BTC to major support levels.

Factor 1: Bitcoin spot buys on the rise

|

| Bitcoin Futures-Aggregated Open Interest. Source: Coinbase, Skew |

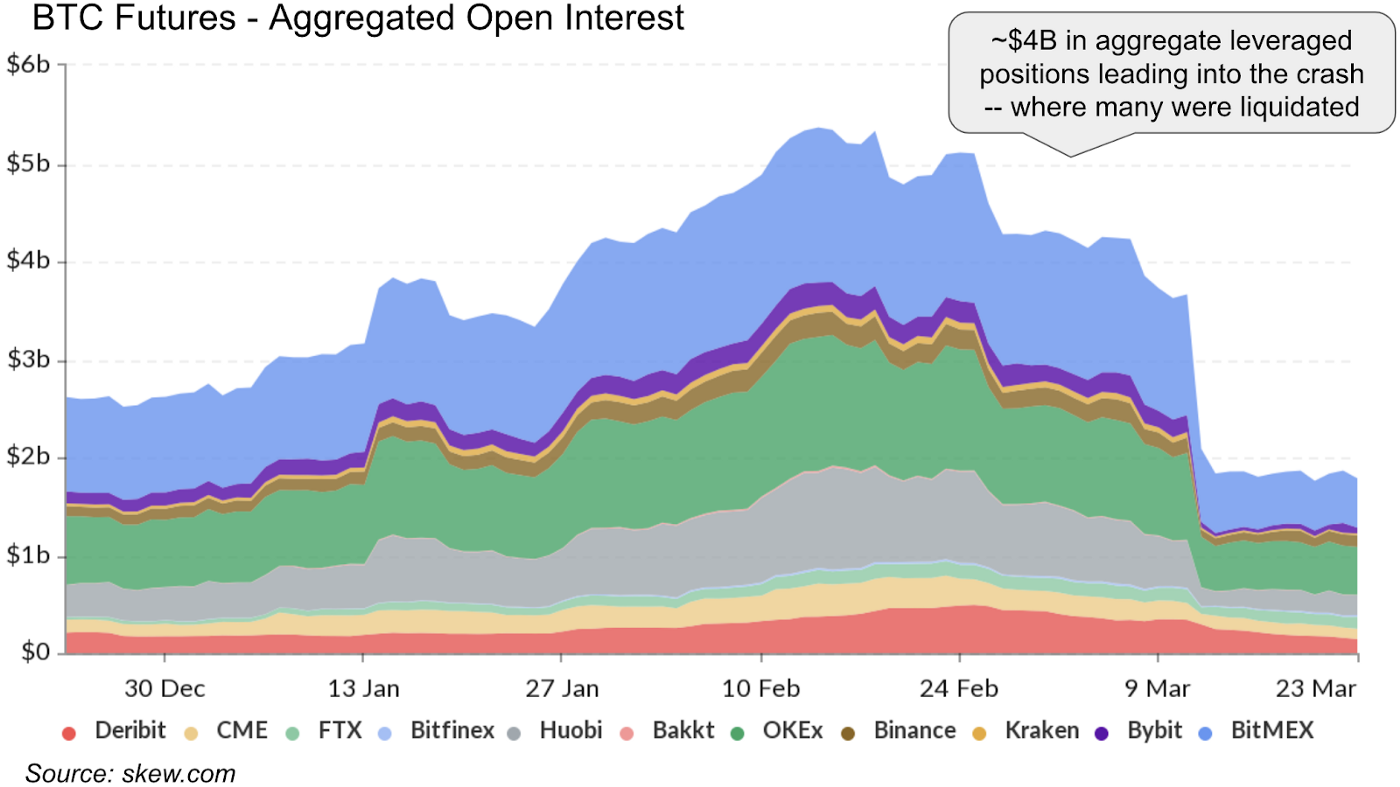

Coinbase, Kraken, Binance, Bitfinex and other spot exchanges saw a substantial spike in buy volume following the March 13 drop that led BTC to drop from $8,000 to $3,600 within a 24-hour span.

Simultaneously, open interest—a term used to describe the total number of long and short contracts open at a given time—plunged across major futures exchanges including BitMEX, Binance Futures, and OKEx.

The sharp decline in open interest on futures exchanges and the clear increase in spot buy volume essentially led to a shift in the market. The spot exchange market began to control the price trend of Bitcoin, rather than the futures market.

The futures market often causes extreme volatility in the Bitcoin price because traders use leverage (borrowed funds) to trade cryptocurrencies, whereas in the spot market, investors are selling and buying Bitcoin without borrowed capital.

The shift stabilized the market, allowing the Bitcoin price to recover without severe pullbacks and with relatively low volatility.

Factor 2: BTC should have never dropped below $4,000 in the first place

On March 31, Coinbase released a blog post detailing the trend in the market after the Bitcoin crash to $3,600.

The exchange said that most users on the platform bought Bitcoin following the abrupt drop, adding that the cascade of liquidations caused BTC to drop much lower on futures exchanges than spot exchanges.

| Coinbase explained: “Cascading liquidations were most prominent on BitMEX, which offers highly leveraged products. Amidst the selloff, a Bitcoin on BitMEX was trading well below that of other exchanges. It wasn’t until BitMEX went down for maintenance at peak volatility (citing a DDoS attack) that the cascading liquidations were paused, and the price promptly rebounded. When the dust settled, Bitcoin had briefly spiked below $4000 and was trading around the mid $5000s.” |

This opens up the theory that Bitcoin should have never dropped to the $3,000s in the first place, which explains the rapid V-shape recovery to $7,350.

Factor 3: Fast recovery to key support levels

Since early 2018, the $5,800 level has acted as a historically important support area. It kept the price from falling to the $3,000 to $4,000 range with the exception of December 2018.

The Bitcoin price recovered from the mid-$3,000 region to $5,800 quickly, within seven days. The $5,800 level acted as a strong floor after being tested three times in March, enabling Bitcoin to see an extended rally.

Several high-profile traders have said that after the breach of $7,300, the $7,700 resistance level is likely to be the next area for Bitcoin to visit in the near-term.

BTC's price is either going to zero or seven figures

In a recent discussion with Morgan Creek Digital Partner Anthony Pompliano, Social Capital CEO and former Facebook executive Chamath Palihapitiya asserted that the price of Bitcoin (BTC) will either reach “millions,” or go to “zero,” CoinTelegraph reported.

For Palihapitiya, the question of whether Bitcoin succeeds will be determined by whether the architects of the existing financial system continue on the current path toward debasement.

BTC price will either go to the moon or the gutter

Palihapitiya asserts that his case for BTC gaining over 100x from its current price rests on deteriorating public confidence in the dominant financial apparatus and money commodities.

“We are driving, slowly, but we are driving towards a cliff. And then, we’re going to drive much, much faster down that cliff or down that hill. And at the end of it is a huge brick wall.”

Palihapitiya’s lofty price predictions are for the much longer term, with the former Facebook executing warning that there is ”a real chance that by 2030 we don’t find a way to inflate our way out of [[crisis]].”

| “The only way to break the back of inflation is essentially to create some quasi form of a gold standard, but it’ll be almost impossible to do that between governments and central banks. They’ll never agree on an instrument and they’ll never agree on an exchange [rate]. But then, bottoms up, people could decide to do it [with Bitcoin].” |

| PM directs to enhance management of Bitcoin, virtual currencies The PM has signed Directive No. 10/CT-TTg on enhancing management of activities related to Bitcoin and other virtual currencies. |

| SBV says bitcoin prohibited in Việt Nam It has since coordinated additional penal sanctions for such acts involving these now illegal cryptocurrencies. |

| FPT University acccepts Bitcoin payment Le Truong Tung, President of FPT University announced on social network on October 26 that the university with accept Bitcoin payment of tuition, which will ... |

In topics

Economy

Economy