Digital Currency Management in Vietnam from Global Experience

| Vietnam Urged to Establish a Legal Framework for Digital Assets and Cryptocurrency Vietnam is being encouraged to introduce a central bank digital currency (CBDC) to regulate digital transactions and integrate with global cryptocurrencies. The government is also ... |

|

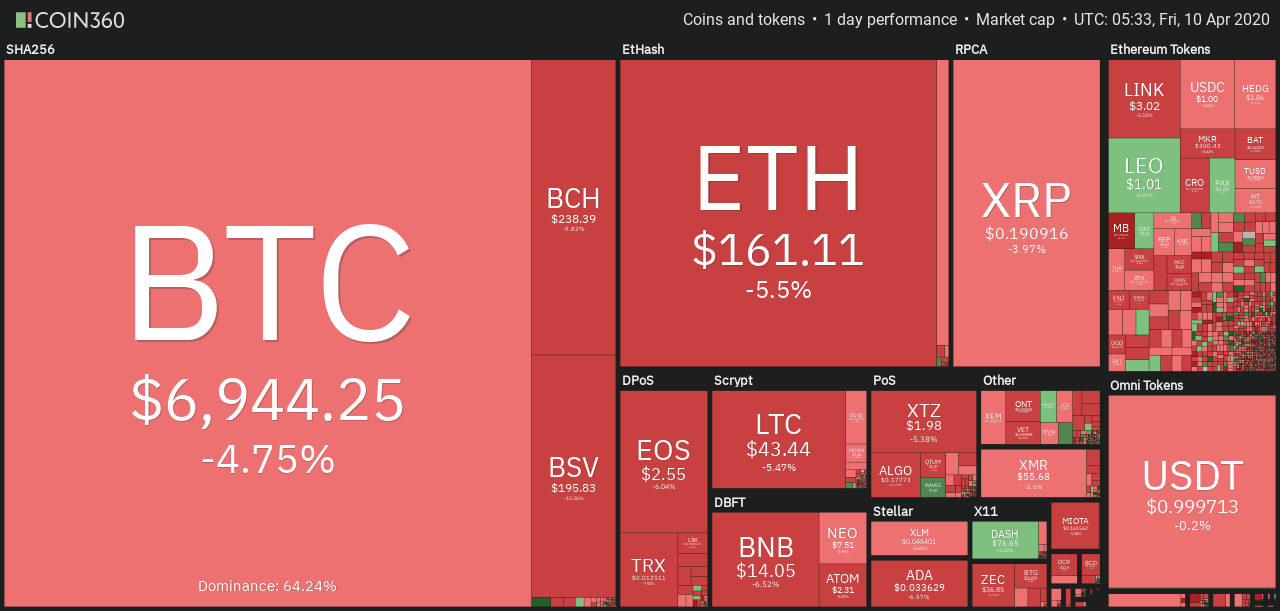

| Customers track Bitcoin information on the Binance cryptocurrency exchange. Photo: https://kinhtedothi.vn |

Recently, cryptocurrency has become one of the most discussed topics in finance. The fast-paced growth of cryptocurrencies has driven many countries to develop and refine legal frameworks for their regulation and development. In Vietnam, despite increasing interest in cryptocurrencies, there is still no comprehensive legal framework governing digital assets.

1. Global and Vietnamese Cryptocurrency Regulations

1.1. International Experience

Globally, cryptocurrency regulations can be categorized into three main groups:

• Legalization with strict regulation: Countries such as the United States, Japan, and Singapore have made significant progress in establishing legal frameworks to control cryptocurrency-related activities. The U.S. enforces strict oversight on exchanges, requiring compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) laws. Japan recognizes cryptocurrency as a legal asset and mandates exchanges to register with financial authorities. Singapore has adopted an open policy, enacting the Payment Services Act, which provides a clear legal framework for companies operating in the cryptocurrency sector.

• Complete ban or strict restrictions: Some countries, including China and India, have implemented stringent measures to control cryptocurrencies. China has banned cryptocurrency mining and trading while promoting its central bank digital currency (CBDC).

• Lack of clear legal frameworks: Several countries, including Vietnam, have not yet established formal regulations for cryptocurrencies. The absence of a clear legal framework poses risks to investors and hampers innovation in this field.

1.2. Cryptocurrency Regulation in Vietnam

Currently, Vietnam lacks a comprehensive legal framework for regulating cryptocurrencies and related activities. According to the State Bank of Vietnam, cryptocurrencies are not recognized as legal payment instruments, and issuing, supplying, or using them for payment is prohibited. However, in practice, Vietnam's cryptocurrency market continues to grow rapidly, with an increasing number of individual investors despite legal and consumer protection risks.

Compared to other nations, Vietnam’s cryptocurrency policies remain cautious. While countries like the U.S., Japan, and Singapore have established clear regulatory frameworks for managing, supervising, and leveraging cryptocurrencies, Vietnam still lacks specific regulations on trading, investment, taxation, or exchange management. As a result, many international exchanges operate in Vietnam without regulatory oversight, increasing risks of fraud, scams, and money laundering.

2. Policy Directions for Cryptocurrency Regulation in Vietnam

Vietnam’s legal system currently lacks a clear definition of digital assets and virtual assets. Countries such as China and Morocco, despite banning virtual assets, still have a significant number of cryptocurrency users. This demonstrates that outright bans are ineffective, whereas a lack of strict oversight could lead to substantial risks. Thus, establishing an appropriate legal framework for regulating virtual and digital assets, including cryptocurrencies, is crucial in Vietnam. The following are key policy recommendations:

• Defining Virtual Assets in the Civil Code: The government could incorporate definitions and regulations for virtual assets in the Civil Code. Virtual assets should be classified as a special type of "non-traditional" asset. While there are various types of virtual assets, Vietnam should focus on regulating cryptocurrencies, as other virtual assets, such as in-game digital goods, have limited economic and social impact. Additionally, classifying virtual assets, as practiced in the U.S. and Japan, could help tailor regulations and maximize their benefits.

• Integrating Cryptocurrency Regulations into Banking Laws: Vietnam does not currently recognize cryptocurrencies as a currency. However, banking laws could treat cryptocurrencies as an alternative payment method under specific conditions, similar to Japan's classification of certain crypto assets for payment purposes or Russia’s permission for cryptocurrency transactions while prohibiting their use as legal tender.

• Implementing Cryptocurrency Transaction Risk Controls: Regulations on cryptocurrency transactions should comply with the Financial Action Task Force (FATF) guidelines for anti-money laundering and counter-terrorism financing. Countries worldwide have introduced extensive policies on this issue, and Vietnam should follow suit by enforcing strict administrative penalties and criminal liabilities for money laundering activities. The Anti-Money Laundering Law must establish robust preventive measures, while the Criminal Code should stipulate severe penalties for financial crimes involving cryptocurrencies. Authorities should also impose stringent rules for illegal crypto transactions, as seen in Canada and Japan.

• Taxation of Virtual and Digital Assets: Vietnam should impose taxes on virtual and digital asset transactions. Income derived from virtual assets should be subject to corporate or personal income tax, similar to Japan’s tax policies. Furthermore, regular tax guidance should be issued through legal documents such as circulars and decrees. The government should implement separate tax regulations for virtual and digital assets, following the U.S. model.

• Consumer Protection Regulations: Inspired by Japan’s experience, Vietnam could establish information security systems or require separate management of customer funds and company assets. Canada mandates transparency in crypto business operations and enforces Know Your Customer (KYC) procedures for anti-money laundering compliance. Consumer protection laws could prevent intellectual capital flight, encouraging domestic investment in virtual assets instead of offshore transactions.

Registration Requirements for Virtual Asset Businesses: Regulations should mandate that businesses and individuals engaging in virtual asset-related services meet specific conditions before obtaining operational licenses. Non-compliance should result in administrative or criminal penalties. Canada’s regulatory framework, for instance, mandates business registration and a rigorous evaluation process before allowing crypto projects or exchanges to operate legally. Initial Coin Offerings (ICOs) that fail to register should be deemed illegal, with offenders facing penalties.

3. Feasibility of Cryptocurrency Legalization in Vietnam

Economic stability, cooperation, and development are global trends. As an integral part of the global supply chain, Vietnam should legalize cryptocurrencies to facilitate seamless commercial transactions. Digital assets represent a valuable economic resource that should not be overlooked, particularly in attracting investors. Establishing clear legal frameworks for cryptocurrency-related matters will encourage investors to enter the market, thereby stimulating economic growth.

Moreover, a well-defined legal environment ensures investor protection against fraud and scams. Transparent and enforceable regulations would enhance accountability, reducing risks associated with cryptocurrency transactions.

From a regulatory perspective, managing financial crimes such as money laundering, tax evasion, and terrorism financing is crucial. Legalizing cryptocurrencies can help minimize their illicit use while leveraging their advantages for preventing and addressing traditional financial crimes.

Additionally, the shift towards a circular economy and digital transformation necessitates blockchain adoption. Legalizing cryptocurrencies would indirectly facilitate the integration of blockchain technology into financial management and broader socio-economic applications.

4. Conclusion

Vietnam must swiftly develop and implement an appropriate legal framework for cryptocurrency management to ensure transparency, protect investors, and drive digital economic growth. Legalization should be gradual, accompanied by financial and cybersecurity monitoring to mitigate risks and promote sustainable development.

| 'Pi mining' fever surges as diggers hope to catch Bitcoin-level profits For the hope of profits in an uncertain future, Pi miners are making trade-offs from phone numbers, personal photos, identification, access to phones, and more. |

| State Bank Deputy Governor: Bitcoin is not legal in Vietnam Deputy Governor Dao Minh Tu affirmed that Bitcoin and other virtual currencies are completely not considered as cryptocurrencies, and not allowed to function as legal ... |

| Vietnam - A Pioneering Blockchain Nation According to experts, a young population and fast adoption of technology are the key factors that make Vietnam become one of the leading countries in ... |

Recommended

Make in Vietnam

Make in Vietnam

Vietnam Considers Regulatory Changes to Import China's Comac C909 Aircraft

Make in Vietnam

Make in Vietnam

Digital Currency Management in Vietnam from Global Experience

Popular article

Multimedia

Multimedia

Vietnam’s Textile Industry Strengthens Position in Global Supply Chains

Make in Vietnam

Make in Vietnam

Vietnam’s Aquatic Exports Aim for US $11 Billion in 2025 with Quality-Driven Growth

Economy

Economy

Vietnamese Products Steal The Show at 2024 Foodservice Australia

Make in Vietnam

Make in Vietnam