Gold price today: Overvalued equities are buoying gold price

Gold prices used Q2 to build a solid foundation and are now ready to make further gains, according to StoneX analyst Rhona O’Connell.

“After the febrile markets of the first quarter, conditions have been much calmer in the second quarter and gold has built a steady and gradual bull run and laying the foundations for further gains. As we enter July, the 2012 high has been taken out and provided the final impetus for a clearance of $1,800; $1,900 is certainly in sight before the end of the year, if not higher,” O’Connell wrote.

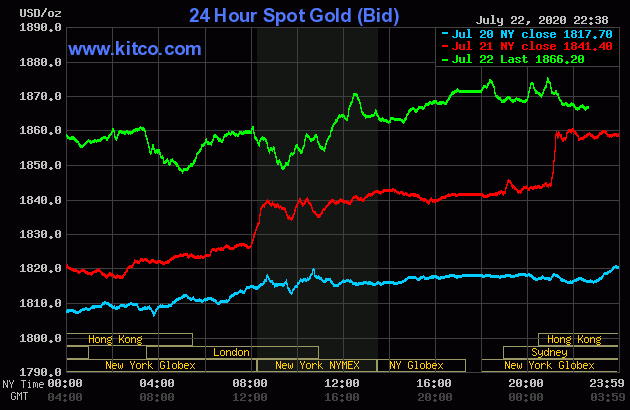

At the time of writing, August Comex gold futures were trading near nine-year highs at $1,867.70, up 1.29% on the day.

|

The price gains in Q2 were led by the western investment sector, which will remain the primary supportive driver for the rest of the year.

“Both professional and retail [sectors] have been very active … Continued uncertainty over the world’s health and the outlook for economic activity and financial risk, coupled with rising geopolitical tensions saw ETF investment in the first half-year of 734t, split as to 458t in North America, 238t in Europe and 38t elsewhere,” said O’Connell.

Gold is “in the perfect storm” and even though the second coronavirus wave has been already priced in, the economic fallout has not been, O’Connell pointed out.

Another major driver for gold has been its role as a hedge against overvalued equities as the Federal Reserve and the European Central Bank balance sheets expanded to $14.03 trillion and flowed into equities, the analyst added.

“Equities are arguably overvalued and this is also buoying gold prices as a hedge against stock market weakness, either short-term spikes or longer-term malaise,” she stated.

And unless there is a readily-available vaccine or a U-shaped recovery, which is unlikely for the time being, gold will continue to see substantial gains.

Eventually, gold prices will step back after the rally is over, repeating their trading pattern from nearly ten years ago, when gold hit its all-time highs in 2011 and then began its decline in 2013.

However, if Asian demand for gold picks up by that time, price falls will be contained, O’Connell said.

“Normally [Asian nations] get used to higher prices within weeks, but this time economic uncertainty prevented this and then COVID-19 took hold,” O’Connell said. “From 2000-2018 inclusive these countries accounted for 74% of investment-grade gold retail pieces. When they do return to the market then this will be an added element of price support … It would help to contain any price falls, however.”

Asian demand for gold bars, coins and jewelry has been on the decline since last year’s price advance from $1,300 to $1,500 an ounce, the report explained.

Gold price more likely to hike

Gold and silver prices are again sharply higher in midday U.S. trading Wednesday. Gold prices have pushed to a nearly nine-year high, while silver is strongly up again today and hit a 6.5-year high. The feature in the global marketplace at mid-week is the gold and silver markets, according to Kitco.

Gold is now not far below the record high of $1,920.70 scored in 2011, basis Comex futures. Safe-haven demand, technical buying, a weaker U.S. dollar index, rising crude oil prices, and increasing consumer demand from China and possibly India are all fueling the bull runs in the two precious metals markets. August gold futures were last up $20.90 an ounce at $1,864.40. September Comex silver prices were last up $1.1403 at $22.96 an ounce.

|

Veteran market participants know that looking at past price history helps in determining where prices are headed in the future. An examination of the monthly continuation charts for nearby gold and silver futures markets shows the next major upside target for gold is the all-time high of $1,920.70, scored in 2011. If that level is taken out, then the $2,000.00 mark would likely be challenged in short order.

For silver, the next upside price objective is longer-term chart resistance at $26.00. Importantly, while gold is near the top of its historical trading range, silver is only in the middle of its historical trading range, basis Comex futures, dating back almost 50 years ago. Such suggests there is much more room to run on the upside for the silver market, as many traders reckon silver is presently undervalued compared to big brother gold.

Look for bigger daily price moves for at least the near term. Remember, too, that even the strongest of bull market runs see significant downside price corrections in the uptrends. Keep reading my AM and PM reports for the early clues on gold and silver price trend accelerations or reversals.

Global stock markets were mostly lower in overnight trading. The U.S. stock indexes are mixed at midday. Traders and investors are more risk averse at mid-week.

China-U.S. relations continue to erode after the U.S. abruptly closed the Chinese consulate in Houston, Texas. China called the U.S. move an “unprecedented escalation” in U.S-China tensions.

President Trump has started doing Covid-19 briefings again and on Tuesday said the pandemic in the U.S. will “get worse before it gets better.” Trump also did an about-face by urging Americans to wear masks.

Hopes of another U.S. government financial aid package to Americans coming quickly have faded this week, amid disagreement among legislators on the package’s contents.

The important outside markets today see Nymex crude oil prices weaker and trading around $41.30 a barrel after hitting a 4.5-month high on Tuesday. The U.S. dollar index is lower in early trading and near this week’s 4.5-month low. The yield on the benchmark U.S. Treasury 10-year note is currently around the 0.59% level.

U.S. economic data due for release Wednesday includes the weekly MBA mortgage applications survey, the monthly house price index, existing home sales, and the weekly DOE liquid energy stocks story.

| Technically, August gold futures bulls have the strong overall near-term technical advantage, to suggest still more upside in the near term. Prices are in an accelerating six-week-old uptrend on the daily bar chart. Gold bulls' next upside near-term price objective is to produce a close above technical resistance at the all-time high of $1,920.70. Bears' next near-term downside price objective is pushing prices below solid technical support at $1,800.00. First resistance is seen at today’s high of $1,871.20 and then at $1,900.00. First support is seen at today’s low of $1,842.10 and then at $1,829.80. Wyckoff's Market Rating: 9.5 |

| World news today: WHO reports record one-day rise in COVID-19 cases worldwide World news today May 20: More than 100,000 new Covid-19 cases were reported to the World Health Organization over the previous 24 hours, the most in one day ... |

| World news today: Tingling pain in hands, a possible COVID-19 indication World news today May 18: If you develop a subtle tingling pain in hands, you might be at risk of COVID-19. Diabetes patients and those with autoimmune ... |

| World news today: Fire and explosion rip through downtown L.A, 11 firefighters injured World news today May 17: A massive fire broke out in downtown Los Angeles Saturday evening, touching off an explosion and leaving nearly a dozen firefighters ... |

World

World

Gold price today: Staying past-$2,000 off-late, recover happens quicker than expected

World

World

Gold price today Aug 18: Rallies 2% and challenges $2,000 per ounce once again

Recommended

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World

India strikes back at terrorists with Operation Sindoor

World

World

India sending Holy Relics of Lord Buddha to Vietnam a special gesture, has generated tremendous spiritual faith: Kiren Rijiju

World

World

Why the India-US Sonobuoy Co-Production Agreement Matters

World

World

Vietnam’s 50-year Reunification Celebration Garners Argentine Press’s Attention

World

World