Dow Jones Futures trade moves higher despite ongoing protest in America

|

| The S&P 500 was up 1.61 points, or 0.05 percent, at 3,045.92, while the Nasdaq Composite was up 29.94 points, or 0.32 percent, at 9,519.82. |

Minneapolis, Chicago, San Diego, California, Washington have been named in the news due to local reaction to the video that showed the black man George Floyd pinned to the ground by a police officer and then died in custody. Business owners are trying their best to protect their property while remaining unsure whether riot damage is covered by insurance. One certain thing is that the riots are illegal, and Trump is pushing for the National Guards to restore order, but it seems like things are getting out of control.

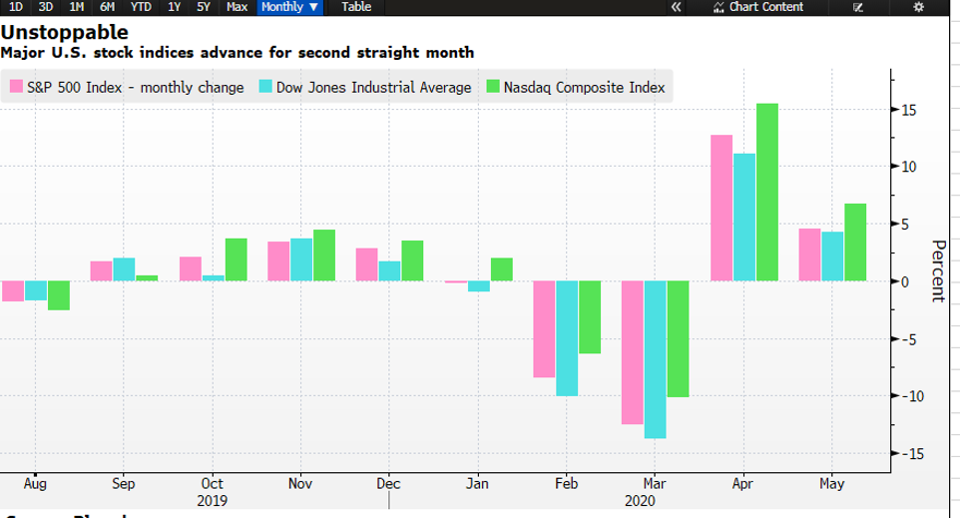

The fact is that if the civil unrest isn’t addressed, it can prolong the recovery process in the U.S. The Federal Reserve has worked hard to restore confidence in the U.S. equity markets, and if investors continue to see National Guards and threats of curfew, it will hurt their confidence level. So far, the three major indices, the S&P500, the Dow Jones industrial average, and the Nasdaq NDAQ have performed exceptionally well since their Covid-19 lows. The chart below shows that the U.S. equity markets have posted two consecutive months of gains.

|

| The S&P500, the Dow Jones and the Nasdaq score another month of gains AVATRADE, BLOOMBERG |

While Economic Times assesses, the US stocksstruggled for direction on Monday as investors weighed prospects of a post-pandemic economic recovery against protests across the country over race and an ongoing standoff between Washington and Beijing.

US manufacturing activity eased off an 11-year low in May, an Institute for Supply Management (ISM) survey showed, the strongest sign yet that the worst of the economic downturn was behind as businesses reopen.

The S&P 500's 38 percent rebound since late March has been underpinned by hopes that the global economy would recover from the coronavirus-led downturn as countries start to ease lockdowns.

"The data is showing a pickup in demand which is a key driver for markets going forward," said Anik Sen, global head of equities, PineBridge Investments.

"The market is reacting somewhat to the rioting and US and China tensions, but it's only at the margin."

U.S.-China Tension

|

The S&P 500 was up 1.61 points, or 0.05 percent, at 3,045.92, while the Nasdaq Composite was up 29.94 points, or 0.32 percent, at 9,519.82.

The Nasdaq composite moved up 0.35% Monday midday. At around 11:45 a.m. ET, the S&P 500 was up 0.15%, while the Dow Jones industrials also gained 0.15%, Investors reported.

Apple (AAPL) rallied 0.7%, while Microsoft (MSFT) fell 0.7% in today's stock market. Dow Jones stock Pfizer (PFE) sold off 8% after disappointing trial results for a breast cancer drug. Eli Lilly (LLY) and Gilead Sciences (GILD) were both lower after coronavirus drug news. Tesla (TSLA) is breaking out today, while Snap (SNAP) is in buy range above a new buy point.

On Monday, China asked its state-owned firms to halt purchases of soybeans and pork from the United States, according to reports. In January, China agreed to purchase U.S. farm goods as a part of the phase-one trade deal between the two nations.

Meanwhile, Reuters reported that China's Foreign Ministry spokesperson Zhao Lijian said, "The U.S. has become addicted to quitting groups and scrapping treaties."

On Friday, President Trump said the U.S. would begin the process to remove its special relationship with Hong Kong after China approved a controversial national security law effectively stripping the city's status as an autonomous district.

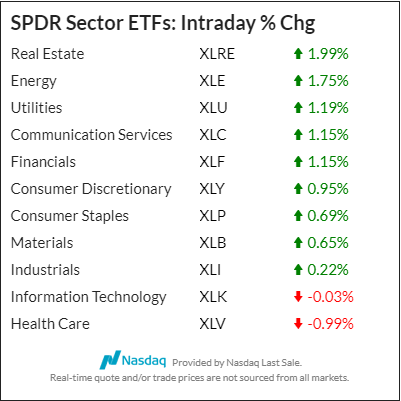

Among exchange-traded funds, Innovator IBD 50 (FFTY) moved up 0.8%. The ETF of top growth stocks is about 13% off its 52-week high. Meanwhile, the Nasdaq 100-linked Invesco QQQ Trust ETF (QQQ) traded down 0.1%, and the SPDR S&P 500 (SPY) ETF was up 0.1%.

The tech-heavy Nasdaq is once again positive for 2020 after the coronavirus stock market crash, up 5.8% through Friday's close. Meanwhile, the S&P 500 and Dow Jones Industrial Average are down 5.8% and 11.1%, respectively, through May 29.

| "Travel bubble" the critical factor helps recover tourism industry. Recently, Zaidi Isham Ismail has published an article on the New Straits Times about so-called “travel corridors” and its pivotal role in re-invigorating the tourism ... |

| Vietnam challenges itself to new goals for economic growth in 2020 When negative impacts of the Covid-19 pandemic on the economy have become clearer, and the economic losses have been basically measured, the Government proposed the ... |

| Vietnam posts nearly USD 2 billion of trade surplus in the first five months Vietnam reported a trade surplus of 1.9 billion USD in the first five months of this year amid the ongoing complexity for global markets caused ... |

Economy

Economy

Stock Price Today (July 11): Tesla stock is on the verge of becoming a 'Bubble'

Recommended

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World

India strikes back at terrorists with Operation Sindoor

World

World

India sending Holy Relics of Lord Buddha to Vietnam a special gesture, has generated tremendous spiritual faith: Kiren Rijiju

World

World

Why the India-US Sonobuoy Co-Production Agreement Matters

World

World

Vietnam’s 50-year Reunification Celebration Garners Argentine Press’s Attention

World

World